Company background

- 國內最大丁晴手套(Nitrile Glove)廠商、高速生產線鼻祖、產能為業界最高、賺幅最高、首家設立生物質能源廠,集多個殊榮于一身

- 賀達麗嘉合成橡膠及天然橡膠手套銷量各為和65%及35%,前者銷量幾乎是同業的2倍。

http://www.chinapress.com.my/topic/business%20weekly04/default.asp?dt=2008-04-13&art=20080413rookies42ee.txt (Year 2009)

- Hartalega is currently the largest nitrile glove maker in the world with

an annual production capacity of 9.6 billion pieces or 6% market share.

It is known to be the most efficient glove maker with first class

product and engineering innovations, which have allowed it to reap

superior operating margins (28% versus 16% industry average) and ROE

(36% vs 22% industry average).

http://www.theedgemalaysia.com/in-the-financial-daily/188290-hartalegas-nitrile-gloves-outpacing-latex.html (June.2011 - FY2012)

梁孙健博士6月份股市月刊。

- 关民亮指出,贺特佳在2003年成为全球首个推出轻量丁腈手套的公司,重量只有7克。贺特佳当年在美国的丁腈手套市占率只有2%,如今已经高达29%。此外,丁腈手套在2004年的销量只有1亿零100万只,2011年却多达59亿4700只,涨幅高达惊人的5788%。这些数字已让贺特佳在2010年成为全球最大型的丁腈手套生产商,全球市占率达17%。经过企业转型后,贺特佳近年来主攻丁腈手套市场,占其销量的91%比重。

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=21 #411 发表于 2011-12-5 小番薯

- 贺特佳创办人关锦安,不是一开始就踏入手套领域这一行的。关锦安曾透露,创立贺特佳前,他经营的是建筑业务,曾是巴生谷高档房产著名建筑商,还有为国内知名政治人物建筑家居的经验。

他后来曾涉足商标徽章织造,且表现不错,惟纺织业渐入夕阳后辗转进入手套业,当时的创业资本有30万令吉。据了解,当时政府批准的手套生产执照接近200家,可见竞争非常激烈,但后来有超过一半倒闭,足可见当初手套业的艰辛。

- 贺特佳于1988年成立之初,先在甲洞营运,1992年将所有厂房集中在雪州巴丁燕带(Batang Berjuntai),透过高度自动化设备提升产能降低成本,也奠定了公司平稳发展的基础。

- 关锦安曾披露,当时公司仅有10条生产线,年产能为7亿只手套。随着医学手套使用常识提高,加上市场需求不断扩大,贺特佳1997年设立第二家工厂,整体生产线拓展至15条,产能提升至12亿只手套。贺特佳的成功有目共睹,公司至今已有43条生产线,产能高达96亿只,意味着在15年的时间内拓展了7倍产能。

- 尽管已有如此佳绩,关锦安仍是不放弃继续拓展公司版图的机会。公司正积极拓展第五厂房的手套生产线,并斥资2000万至3000万令吉增添另外2条生产线。此外,公司也会耗资1亿7500万令吉在Bestari Jaya的现有厂房旁,兴建第六厂房,预计将在2013年中完工。以这两项拓展计划为目标,贺特佳放眼在2015年之际,产能能拓展40%至135亿只手套。

- 关锦安刚开始创立贺特佳时,公司主要生产天然橡胶手套,但2003年因市场竞争过于激烈而转向丁腈手套市场。相较之下,天然橡胶占原料成本较低的优势,用途也广;而丁腈手套赚幅却较好,不仅不会引起使用者对橡胶中的蛋白质敏感这个优点,成长潜能比前者还高,而且也不会受到乳胶价格波动太大影响。与乳胶手套相比,丁腈手套已越来越受欢迎,特别是美国及欧洲,占全球手套需求的68%。这几年来,贺特佳在美国丁腈手套市占率已从当年的2%,扩大至近30%,全球丁腈手套市占率料达17%,此业务甚至为公司做出高达90%的收益贡献。

- 关锦安的宏愿,是将贺特佳发展成为“拥有最高品质和最创新产品的全球第一手套生产商,同时也要被大众认为是注重社会与环保责任的企业。”据贺特佳的年报记载,关锦安建立了一套管理价值观,不仅要确保品质的重要性,也会鼓励员工通过高科技技术,生产具创意与创新性的产品。除了不断向外拓展,他也十分注重研发部门,希望能通过高科技提高营运效率,他深信这可产生可观的长期赚幅,特别是成本降低能够在领域削价战中保有公司优势。关锦安仅有中学学历,也没有任何工程相关背景,但许多人都不知道,他可是公司研发高速生产线的大功臣,这就是他带领贺特佳蓬勃发展的成功因素之一,只有不断的革新,才能够成为顶尖业者。

- 据了解,关氏家族的第二代关民亮和关民敬已经进入公司董事部。关民亮目前是非独立执行董事,兼任副董事经理,俨然已是公司第二把交椅。另一位儿子关民敬目前则担任行销部董事,亦是非独立执行董事。

- 目前美国销售占贺特佳总销售的75%,而新兴市场的比例少于5%。贺特佳目前计划为新兴市场供应天然橡胶手套,包括中国、印度和南非。

http://www.nanyang.com/node/424916?tid=855 (Feb.2012 - FY2013)

- Established in year 1988

- World's largest OEM nitrile glove producer

- Most profitable glove manufacturers in the world

- 95% of gloves produced are nitrile gloves

- Installed capacity of 10 billion pieces per annum. 5 production plants located in Bestari Jaya, Selangor

- Total workforce of about 3,000 where 35% are skilled workers

- 尽管油价上扬,但却不会对Harta带来直接冲击,因为该公司主要产品nitrile gloves原料为制作轮胎的butadiene,为石化半成品之一。所以,Harta原料成本受汽车领域好坏所主导,而汽车领域目前因经济衰退而表现不佳,这对于Harta仍属一项利好的消息。(TBW 24.9.2012)

- 赚幅收缩:由于更多业者加入nitrile gloves,以致该公司2013年首季(4-6月)税前盈利赚幅从去年32.3%挫跌至28.2%。(TBW 24.9.2012)

- Most efficient glove maker in the world through engineering innovation

- Operation of the world's first double former production line in end of year 2004 (patented)

- 1st automated mechanical stripping system in the industry able to remove nitrile gloves of hand moulds

- Highest production capacity in the world - above 30,000 pcs/hr

- Harta每小时能生产4万只手套,但同行仅为2万6000只。(TBW 24.9.2012)

- 同行需要8人来生产100万只手套,而Harta仅需要4人就能做到。(TBW 24.9.2012)

- Removing nitrile gloves off the moulds at above 30,000 pcs/hr (at that rate, it is human impossible)

- Industry's first glove staking device (patent pending)

- Products are 100% export to countries like USA, Europe, Japan and China

- Started with export only to USA in 1988, today products are sold to 39 countries globally

- Customer base of 137 customers and growing

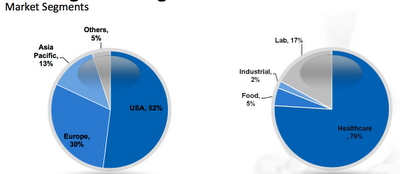

- Market segments

- Share of USA nitrile glove market increased from 2% to 18% in 7 years (about 20% share of US synthetic glove market)

- Sale of nitrile gloves to Europe increased by 5 times in 6 years

- Created new demand for light weight nitrile gloves - World's first 3.7g nitrile glove in year 2007, launched first in the world 4.7g nitrile glove in year 2005

- Efficiency

Reduced staff costs achieved through cutbacks of workers in the unskilled category through automation

Higher skilled workforce is required for development and management of more sophisticated technology.

For the period from 2006 to 2012, ratio of "Technical and management" staff of total workforce increased from 21% to 35%.

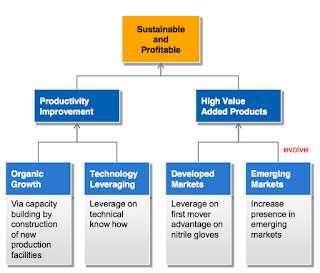

Organic growth

Plant 6 commenced construction in Jan 2012, completion in year-2013

第6号产房在9月开始投入营运 (TBW 24.9.2012)

第6号产房将在2013年6月完成10条生产线,届时其产量将提振30%或35亿只 (TBW 24.9.2012)

10 lines for nitrile gloves

Additional 3.5 billion per annum

RM175 million capex

Where's the next wave of capacity growth?

- Next Generation Integrated Glove Manufacturing Complex (NGC)

Projection of NGC output:

Expectations:

In 2002, Hartalega invested in the research and development of thin nitrile gloves that can be used by health-care professionals and patients allergic to rubber protein.

“At the time, nitrile gloves were chiefly used in industrial applications and not in the medical sector due to their heavy weight and thickness, which was a hindrance for medical practitioners in the examination of patients,” said the billionaire’s 37-year-old son, Mun Leong. “Nitrile gloves are a necessity as there are people who are allergic to rubber protein.” Kuan introduced the world’s first 4.7-gram nitrile glove that bore the elasticity and softness of natural rubber, without the protein allergy risk. The lightest nitrile glove that Hartalega currently produces weighs 3.2 grams, his son said. Global demand for the synthetic gloves is set to grow as much as 20 percent a year till 2014, he said.

Management

- 帶領公司更上一層的靈魂人物關錦安研發高速生產線時,曾在廠房裡待上兩個晚上,日夜鉆研。殊不知,僅有中學學歷、且沒有工程相關背景的他,是研發高速生產線的功臣。

-關錦安說:“我們不願成為手套業者之一,我們要成為頂尖業者(the best)”。

-他深諳研發是賀達麗嘉強項及重要性,因此持續投以資金精益求精,更拒絕將勞資視為節省成本的第一開刀對象,堅持以技術替代人力,要求高效率。

-看著自己創立的公司歷經20年風雨,久屹市場,關錦安敢言:“不管國內或國外,業界無人不曉賀達麗佳,不知賀達麗佳者,不能成為手套業一分子。”

- 關錦安坦言不愛唸書,高中畢業后即加入家族企業,70年代時經營建築業務,曾是巴生谷高檔房產著名建築商。26歲的時候,他想做一些“自己”的事,于是涉足商標徽章織造,且經營得有聲有色。后來,眼見紡織業漸步入夕陽,于是輾轉了一陣子后,以30萬令吉資本投入手套制造業。

“公司營運策略是注重長期成長;去年表現雖因H1N1流感而異常亮麗,惟只屬短期現象,醫藥領域需求才是長期成長因素,就像美國醫療改革,可為產品長期銷量增添新動力。”公司董事經理關錦安表示

Harta董事经理关锦安,放眼营业额增长15%至25%。关锦安出席公司常年股东大会和特别大会后的媒体汇报会,发表上述谈话。

The world’s largest nitrile glove maker, Hartalega Holdings Bhd says the recent allegations against the company has caused damages running into millions of ringgit.It says the allegations had come despite its total compliance of all regulations.

"We want to stop the bleeding. Our stock price is being affected, our shareholders are concerned and 635 of our employees are under tremendous stress due to these allegations," its managing director, Kuan Kam Hon said today.

- 贺特佳算是一家比较传统的家族企业。关氏家族的第二代,关民亮和关民敬都已进入公司,是公司安排接班的一项部署。父亲关锦安和贺特佳董事经理,关民亮已是公司第二把交椅,关民敬则担任行销部董事。

- 关民亮表示,贺特佳已拟定40至45%的派息政策,希望可在扩充业务和回馈之间找到平衡点。他笑说[不管公司在做什么,我们都会以股东利益为主,股东回酬是我们的KPI!]

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=21 #411 发表于 2011-12-5 小番薯

- 賀特佳在1月31日發文告表示,由於關錦安所增持的股權僅僅涉及控股公司--賀特佳工業私人有限公司的股權,而非賀特佳,因而對26日作出的大股東股權變動作出澄清,並取消相關調整。根據26日的大股東變動詳情,當中指出賀特佳工業已額外增持1814萬7000股,從而將總持股比例提升至55.45%。

- 隨著上述的澄清,大股東的持股實際上是保持在50.47%或1億8392萬7152股。

- 而賀特佳在1月20日發文告表示,關錦安分別以1870萬令吉和1億6830萬令吉,向山努西與莫哈末再益斯收購Budi Tenggara私人有限公司10%與90%股權。Budi Tenggara乃賀特佳大股東--賀特佳工業的股東之一。因此,在收購上述股權後,關錦安在賀特佳工業的持股比例,從37.61%上升至51.47%,從而成為控制性的大股東。

- Despite its consistent earnings

outperform ance and im peccabl e fundam ental s, Hartal ega remains

severely undervalued due to its low liquidity. Mr Kuan and family now

own 56.45% of the company post the acquisition of Budi Tenggara,

which holds a direct 5% stake (completed on 26 Jan 2012). However,

average daily trading volume of the stock is still poor at only 271,401

shares, representing a mere 0.3% of total shares issued.

- Given that management plans to boost its

share trading liquidity and Hartalega has a high RM373m reserve on its

balance sheet (RM364m retained profits, RM3m share premium), we

estimate that Hartalega has the capacity to undertake a bonus issue

(current share capital is RM182m comprising 363.9m shares of 50sen

par). Additionally, we think that Mr Kuan could also place out the 5%

stake acquired from Budi Tenggara, but at a much later stage when the

stock is valued at a more attractive valuation to Mr Kuan.

(Maybank IB Feb.2012 - FY2012)

- Kuan says industry players thinking there is more money to be made from nitrile gloves will be in for a tough time.

“Everyone assumes nitrile delivers better margins because they take our numbers. But when they start doing costing, they take a blended cost, but most operations are not sophisticated to do costing on each and every product,” he says.

- Furthermore, he says, as companies shift the product mix towards nitrile, they may find their costs will also rise. That, he thinks, is why Hartalega's rivals are not seeing the expansion in margins even though the are aggressively moving into the nitrile glove market.

- “Nitrile production cost is actually higher than latex but because of the material savings, the selling price is low.”

- Will the world's leader of nitrile rubber gloves on day go back to making latex gloves?

“When the day comes when we need to do latex, we will but we believe our margins then will be in the teens. The same lines will be used but we can run the lines faster and our yields will increase.”

http://www.thestar.com.my/story.aspx?file=%2f2012%2f4%2f7%2fbusiness%2f11064003&sec=business (April.2012 - FY2013)

- “在客觀地分析各種因素後,我們放眼在2021年晉身成馬股25大企業之一。”關錦安

http://biz.sinchew.com.my/node/59885?tid=6 (May.2012 - FY2013)

- 关锦安重申,贺特佳不会涉足上游业务,而是继续专注於改善增加產能的科技,减少对劳工的依赖。「我们的新生代手套製造厂房(NGC)將採用新研发的科技来生產手套。在这之前,我们將会在第6號厂房对这项新科技进行测试。」

- 另一方面,儘管有分析员认为胶乳价格回落后,市场对手套的需求,可能会从丁手套重新转移至天然胶手套,但关锦安强调贺特佳不会改变其营运方针。他解释,贺特佳拥有生產丁手套的最顶尖科技,每件手套的重量只有3.2克,而天然胶手套最轻的重量只有4.8克,因此相对而言,丁手套仍有其利基市场。

-「我们不介意牺牲赚幅,以收薄利多销之效。但大前提是必须確保每股净利(EPS)持续取得增长。」

- 展望將来,关锦安依然看好全球手套市场的前景。他预测,全球手套市场的整体產量將从目前的1500亿件,提升至2020年的3000亿件。换言之,手套市场仍有庞大的成长空间。

- It said his had spurred a significant increase in nitrile gloves production capacity by the industry which it was confident would be more than matched by resilient demand dynamics.

- ‘Furthermore, we do not expect a price war from the second half of 2012, as claimed by certain quarters as global demand growth continues to outpace growth in industry capacity,” it said.

- The company said that on the contrary, it had to put some of its customers on allocation for their April 2012 purchase and beyond despite adding two new production lines in plant 5 to meet escalating demand.“Based on our experiences, there are no expectations for a price war in the foreseeable future.

- Executive chairman and managing director Kuan Kam Hon said Hartalega always had the interest of shareholders in its mind before embarking on any project.He said the land could set the company back by RM100mil if it did not get the regulatory approval. “It's an ambitious target to start construction by December. The worst-case scenario will be March 2013.”

- Harta执行主席兼董事经理关锦安表示,希望政府能给予手套业者税务优惠,以感激业者对国民总收入(GNI)的贡献。他表示:“我们不寄望政府给予津贴,这样业者会过于依赖津贴以取得盈利。比起津贴或是拨款,税务优惠是较合适的选择。”

- 针对公司耗资15亿在雪邦打造新一代整合手套制造中心(NGC),关民亮表示,公司目前正等待有关方面给予兴建厂房的批准,预计可在今年内获得批准,并在今年年杪开始建筑工程。执行主席兼董事经理关锦安补充,由于涉及庞大投资,因此公司决定获得批准以后,才与地主签署买卖协议。

- 关民亮指出,贺特佳的派息政策不会因为扩展计划而受影响,并维持45%的派息政策。

- Harta宣布,董事经理关锦安从即日起卸任,但将继续出任集团执行主席一职,而董事经理的空缺将由现任执行董事兼副董事经理关民亮接棒。

- 他表示,该公司致力于加强营运能力以及技术革新,目前是全球最大的优质丁腈手套生产商,按年产量逾100亿只。

- 尽管已经退下董事经理一职,但关锦安认为,这并不是终点,他说:“依我在公司的显著持股权以及执行主席职位,我有意继续活跃于公司业务,但从现在起,将从另外一个角度出发。”

- 今年36岁的关民亮,是于2001年加入该公司的工程部。2008年,他获委任为执行董事,之后出任副董事经理职位。关民亮在1999年考获澳洲莫纳什大学的机械工程学士学位,以及在2007年获得苏格兰斯特拉斯克莱德大学的工商管理硕士学位. 他在贺特佳任职期间,领导产能扩充计划,不仅把产能提高7倍,还监督生产技术上一些前所未有的技术突破。

「我们也採取了一些措施,通过培训课程栽培我们的员工,打造一支可以带领贺特佳前进的优秀团队。」

- Management believes that global demand for nitrile rubber

gloves will continue to grow at a high rate of over 20% and

the commencement of Plant 6 with an expected 30%

(+3.9bn pcs pa) boost to its production capacity will capture

this growing market.

(HongLeong IB May.2013 - FY2013)

安聯指出,賀特佳管理層已展現對有關發展計劃的強勁承諾及準備,特別是將員工人數,已從2012年的2千900人,增加至目前的3千900人。

市场一度传言手套领域将掀起削价战,但贺特佳管理层相信,目前和未来市场需求仍高于供应。

賀特佳這項業務拓展計劃將於今年9月動工,預料一年後將有6條生產線投入運作,屆時將有助提高公司的競爭力。然而,由於該公司旗下第六廠已於2013財政年竣工,而新生產線卻仍需1年後才得以投入運作,因此關民亮預料2014財政年的業績,不會享有2013財政年的增長率。

展望2014財政年,关民亮表示该集团于上財政年的业绩成长主要来自于其第6座厂房的加入,惟考虑到该厂房目前已全面投產,因此本財政年將无法取得与上財政年同等的成长率。「现在最重要的便是儘快开始新一代综合手套制造中心的运行,以便能够带领我们步入另一个成长阶段。」

Kuan stepped down as managing director in November while remaining executive chairman, paving the way for his son, Mun Leong, to helm the company. The younger Kuan, who holds a mechanical engineering degree and an MBA, joined Hartalega’s engineering department in 2001, according to the company’s annual report. The patriarch’s older son, Kuan Mun Keng, 38, a certified practicing accountant, is executive director at the company and oversees sales and marketing as well as corporate finance.

- The group’s 2QFY14 forex losses swelled by RM6.5mil, as it

hedged forward its USD receipts at a lower rate when the USD

appreciated by 3% against the RM. Stripping out 1HFY14’s total

forex loss of RM12.7mil (an unprecedented amount), Hartalega’s

normalised net profit would be higher at RM139mil, indicating a

healthy YoY growth of 23%.

(Am research Nov.2013 - FY2014)

- 随着股价节节攀升,通过Hartalega工业私人有限公司持有50.15%股权的关锦安及其家族,财富也随之水涨船高。《南洋商报》根据上市资产估算,关锦安于2013年的财富劲升57.6%,或11亿3200万令吉,累积财富达30亿9700万令吉。随着财富增加,他在南洋富豪榜的排名也大跃进,从上一届的第20名,连跳4级,本届排在第16名。

- 关锦安接受《星报》访问时也曾表示:“我们的赚幅非源自于高价格售卖丁腈手套,关键在生产效率。”贺特佳董事经理关民亮认为,大马手套领域已失去劳工成本低廉的竞争优势,取而代之的是自动化。因此他建议,手套业者应探索创新之路,以减缓成本高涨的影响,所以投资在科技是关键之举。

- 如此注重社会及环保责任的关锦安,却曾在2010年杪时遭工厂附近的居民投诉,指工厂运作时飘出含有化学物气味的气体,且怀疑含有化学物的污水流入河中,造成河水污染。当时,关锦安立刻召开记者会,反驳居民认为工厂污染河流的指责。他强调,当年创办工厂时,把照顾生态环境列为企业愿景,且实际地履行企业责任。关锦安表示,贺特佳每年耗资530万令吉进行空气及水源净化护理工程;同时,工厂所使用机械都是欧美进口的绿色环保概念器材。面对此斥责及投诉时,关锦安当时直言感到失望,因为这已否定该公司多年来为社区做出的贡献。面对此斥责及投诉时,关锦安当时直言感到失望,因为这已否定该公司多年来为社区做出的贡献。关锦安设厂时,当时附近尚未出现住宅区。然而,住宅区出现后,该公司多年来始终秉持着回馈社会,并关怀环境的宗旨,每年投入100万令吉进行社区福利活动。其中包括赞助爱滋病患及妇女免费医药协助,自主老人院、孤儿院及福利中心等。

-贺特佳的愿景是希望成为世界第一的手套制造商,为世界提供最佳及最创新的手套,同时,也要被公认为是家关怀社会及环境的企业。关锦安注重的不仅是生产手套的科技研发,也非常讲究爱护环境及环保。正当大马大部分的工厂都依赖天然气作为燃料时,贺特佳是首家使用空油棕果串作为生物质燃料的手套制造商,为生产过程制造热能。为了补充燃料供应及达到能源节省效应,许多公司的工厂都以油棕籽壳作为燃料。比起用空油棕果串更便宜。然而,贺特佳最终仍决定选择空油棕果串作为燃料。对此,董事经理关民亮称:“相较于使用天然气,使用空油棕果串使我们的能源节省高达30%。”另外,空油棕果串供应充足,价格稳定;反之,油棕籽壳的供应则较少,价格也相对地较高。鉴于预见此类问题,贺特佳才会决定使用空油棕果串作为辅助燃料。

- 回首一路走来的辛苦历程,关锦安认为,成功没有捷径,这是一趟旅程,而不是个目的地。

- 如今,在贺特佳逐渐步上稳定之路,关锦安也逐渐放心让第二代接棒。关锦安是在2012年11月中,宣布卸任董事经理一职,由当时的执行董事兼副董事经理关民亮接棒。关锦安卸下董事经理的职位后,仍留在公司内担任执行主席。关锦安曾表示:“对公司来说,这个改变是好的,我很高兴可以把这个责任交给民亮。无可否认的是,他将可扮演好这个角色,带领公司取得更好的业绩表现。”尽管已经退下董事经理一职,但关锦安认为,这并不是终点。他认为:“依我在公司的显著持股权以及执行主席职位,我有意继续活跃于公司业务。但从现在起,将从另外一个角度出发。”

- 关氏家族曾披露,不会用数字金额来表现该公司在研发工作所付出的努力,因为他们不想让员工认为“创新”仅能有如此狭窄的定义。

- Looking ahead, with its existing plants running at optimum capacities, sales volumes will remain relatively flattish at least until 3Q15. However, management reiterated that 4Q14 margins are expected to sustain in subsequent quarters and start improving once the NGC plant 7 begins commercial production due to economies of scale.

- HART highlighted that its Next Generation Integrated Glove Manufacturing Complex (NGC) is on track to commission operations gradually from Oct-14 onwards with a planned commissioning of 2lines per month. Upon full commissioning, the first two plants will add c.8b pieces (+56%) new capacity by Oct-2015 and providing the much-needed earnings growth for FY16. Hartalega appears relatively confident that capacities for the first plant will be absorbed upon commissioning. We understand that a major client has been found to take up a sizeable portion of the first plant production.

(Kenanga Research April.2014 - FY2014)

- The NGC (Next Generation Integrated Glove Manufacturing Complex) project in Sepang is expected to commence operation by October 2014.

(HongLeong Research April.2014 - FY2014)

- 全球市场每年生产的手套是大约1700亿只,每年的增幅则是8-10%。根据我们掌握的资料,本地手套公司未来2年的新增生产力是320亿只。手套产量每年的平均增幅是8%,而需求则是每年增长14%。从以往的情况来看,持续成长中的市场需求将吸收手套公司的新增产量。因此,我认为手套领域中期内不会出现供应过剩的情况。中国和印度对手套的需求成长潜力极高,目前每人平均只使用4只手套,远低于没有每人140只和欧洲的每人100只。我们业相信中国的医疗改革将进一步带动手套需求。-关明亮。

Busy Weekly July.2014 - FY2015

- Hartalega在上一轮的配水措施中并没有面对水供中断的困扰。因为我们已经有应急措施,确保任何时候都可以获得充足的水源。展望未来,即使再次爆发水荒危机,我们也不认为Hartalega会面对水供不足的冲击。-关明亮。

Busy Weekly July.2014 - FY2015

展望未來,管理層表示全球丁腈手套需求繼續在膠手套需求轉向趨勢下書寫19%成長率,雖然領域產能同步增加,但卻不預見發生價格戰,主要因全球需求仍然強穩。無論如何,管理層坦言原料價格下滑和售價面對更激烈競爭,卻將導致手套平均售價下滑。雖然偏低售價對業績造成的影響繼續讓管理層關注,可相信NGC項目將捍衛維持集團盈利

http://biz.sinchew.com.my/node/99648?tid=6 August.2014 - FY2015

不過,管理層在匯報會上強調,手套業並未出現削價戰,產品價格調低的原因在於原料跌價、訂價策略。

http://biz.sinchew.com.my/node/99701?tid=18 August.2014 - FY2015

另一方面,对於市场关注的手套供应过剩问题,关民亮指出,在未来2年的新增產能將是320亿或每年160亿只,而隨著国际一些手套厂房关闭,以及手套需求持续提升,尤其是新兴市场,所以他认为,手套市场將不会出现供应过剩的情况。

http://www.orientaldaily.com.my/index.php?option=com_k2&view=item&id=134352:3&Itemid=198 August.2014 - FY2015

对于市场传出全球手套或供过于求,关民亮则不认同。 “回顾去年,大马丁腈手套出口增加了19%,这是全球需求仍强的最好证明。虽然根据报告,领域产量也同步增加,料未两年会增320亿只手套,但我相信市场仍有能力吸收。”他解释,除了市场需求每年稳定增长外,近期一些国际手套公司结业,释放了更多市占率。此外,他认为领域总产能提高计划通常不如预期,所以未必能够如愿。

Customer

- 該公司手套供應予醫療中心、牙醫所、研究、科學實驗室及食品業等領域。

- 產品幾乎全供外銷,海外市場包括歐美、亞洲、澳洲及非洲。此外,目前計劃強化中國及印度市場地位,為未來發展鋪路。

- 賀特佳的膠手套以出口為主,其中來自美國的兩大客戶Medline與Microflex,佔了總銷量的50%,過度依賴大客戶亦有風險。

- 我们估计贺特佳在全球手套市场拥有大约4.5%的份额

- 公司董事經理關錦安在常年股東大會後指出,公司產品有75%出口至美國,其中丁晴手套在價格和品質因素下,使用程度日漸廣泛,對未來前景表示樂觀。除先進國家外,還有意打入發展中市場,尤其看好中國手套人均使用量只達每年1.4隻,發展前景可觀。

- 他說,美國佔總出口75%,近83%皆供醫療用途,所以美國醫療市場轉用丁晴手套對賀特佳而言是有利的,並放眼今年該手套領域能以約20%至30%幅度持續穩定成長。

- 有鑒中國對手套需求仍低,關民敬指出:“雖然已有與部份當地客戶接洽,但不能說我們會大量出口至中國,因當地衛生意識有待提高,每人平均僅使用1.4只手套。” 關民亮表示,即使是出口,也會是乳膠手套而非丁晴手套;所以我們仍會生產乳膠手套來應付發展中國家的需求,如印度、中國及南美州。

- 他补充,集团也有意出口丁晴手套至巴西;不过,目前还在洽谈。

- 与乳胶手套相比,丁晴手套已越来越受欢迎,特别是在美国及欧洲,这两个区域占全球手套需求的68%。

- 根据目前的产能规划, 贺特佳很可能在几年内,成为世界最大的丁晴人造胶手套生产商。

- Hartalega, which exports 100 per cent of its products to 137 international clients in 39 countries.

- Hartalega, which holds 35 per cent of the U.S. nitrile glove market, is also listed by Forbes Asia as one of the 200 "Best Under a Billion" companies.

- Hartalega has for the first time started to sell nitrile gloves to Argentina this month. Kossan will dedicate a few of its recently installed 22 lines for the Brazil nitrile market. ASP-wise, Top Glove has now quoted its nitrile gloves on par with its low-end latex powdered gloves and is considering accelerating the expansion into the nitrile gloves segment via M&A.

- The two biggest nitrile glovemakers (Hartalega and YTY Industry Sdn Bhd) have insignificant sales to Asia and close to zero sales to South America currently. The only notable nitrile glove supplier in South America is Latexx Partners Bhd.

- We think the factors constraining nitrile glovemakers selling to the emerging markets are: (i) sticky regulations in Brazil limiting Hartalega’s nitrile glove exports (it is able to meet the quality required but not the thickness); (ii) nitrile glovemakers’ strategies to focus sales on the highly regulated/affluent markets (US and Europe) where their lower-end peers will not be able to compete.

- 賀特佳預計日本的丁晴手套使用量在未來數月或增加(震後狀況)。目前,該公司產品9%的出口是運往日本,以營業額計算,這相等於約6千萬令吉,以產能計,表示大約8億件手套。

- 該公司的營運使用率為85%,接近全面產能水平,這表示需求走高,或無法帶來規效益,直到第六間廠在2013年投入運作。

- 與此同時,分析員透露,管理層下週將前往中國會見手套分銷商,以商討供應合約。

- 分析員稱,在手套需求上,中國的全年人均使用率只有2.2件,與北美洲的96件及歐洲的49.9件相差太遠。

- 雖然該公司目前還未獲得任何中國訂單,但管理層願意與中國分銷商面對面展開洽談,已是踏出很好的第一步。

- Over the next week, management will

be in China where it has scheduled meetings with glove distributors to discuss supply

contracts. Recall that in Dec 2010, Cardinal Health Inc (CAH US; Not Rated) acquired

China’s largest importer of medical supplies Yong Yu. Cardinal is a global healthcare

distributor that outsources glove manufacturing to a number of Malaysian glove

companies including Adventa, Kossan, Latexx Partners and Top Glove.

-

Currently, 5% of Hartalega’s sales are to Japan.

[CIMB Research April.2011 - FY2011]

- CIMB Research said Hartalega is eyeing Brazil as a source of earnings

growth and expects to make its first shipment of natural rubber (NR)

gloves by year-end. The glove maker is positioning itself for a change in regulations in

Brazil that will allow hospitals to use nitrile gloves, which is

Hartalega’s specialty.

http://sg.news.yahoo.com/cimb-research-retains-hartalega-tp-rm7-18-000852620.html# (July.2011 - FY2012)

- 目前,歐洲市場占賀特佳總銷售額的21%。

http://www2.orientaldaily.com.my ... MtM0tcf8Z6308049qxW (July.2011 -FY2012)

- 賀特佳董事經理關錦安透過文告指出:“從乳膠手套轉用丁手套風潮正于歐洲市場蔚然成風,且目前當地丁需求也不停在增加。” 因此,歐洲市場對賀特佳的銷量貢獻也跟著提高,從上財年同期的18%增至今年首季的28%。

http://www.chinapress.com.my/print/241360 (Aug.2011 - FY2012)

- As at December 2010, demand in Asia-Pacific accounted for about 10% of Hartalega’s market segment. Subscribing to a stake in Yan Cheng Pharmatex Medical Equipment Co Ltd

will help the company expand its wings further in the China market.

http://www.theedgemalaysia.com/in-the-financial-daily/191093-a-prosperous-quarter-for-hartalega.html (Aug.2011 - FY2012)

- 关锦安披露,美国和欧洲市场分别占贺特佳的销售额55%和28%。 在丁腈手套方面,美国的销售额逾50%,而欧洲市场则为22%。“我们认为,美国与欧洲的丁腈手套增长空间非常大,预计这两个市场将持续增长。我们预计,今年的丁腈手套需求将持续增长30%,继而推动贺特佳丁腈手套的增长。”

http://www.nanyang.com/node/377045?tid=485- (Aug.2011 - FY2012)

-關錦安也透露,該公司在中國的業務已開始投入運作,但基於這項業務剛起步,且仍需時才可達到損益兩平,因此,預計中國業務將於2013財政年才會開始作出貢獻,不過,由於目前的中國市場手套需求不高,因此貢獻料不顯著。雖然如此,關錦安指出:「中國是主要經濟體之一,且人口稠密,因此相信是我們未來的主要市場之一。」

- “We expect more growth from Europe, we have recruited many multinational companies there as clients and it makes for a sizable market,” said managing director Kuan Kam Hon after the company’s AGM yesterday.

- Kuan sees vast potential in the European market as nitrile gloves account for only 22% of the market there, which is dominated by natural rubber gloves, and consumers are gradually shifting to nitrile. “Like the US, customers in Europe are starting to prefer nitrile as its price does not fluctuate too much, and is no volatility with contractual supply,” he said.

- “Malaysia’s exports of nitrile gloves rose 54% last year. They are definitely gaining at the expense of natural rubber gloves, which have limited potential to grow,” he added.

- In terms of geographical breakdown, sales to North America remained steady, accounting for 55.3% of total revenue in 2QFY12 (1QFY12: 55.5%). Demand from Europe continued to grow strongly, with its proportion of revenue contribution rising from 27.6% in 1QFY12 to 33.2% in 2QFY12. We expect demand from Europe to remain robust as the demand switch to nitrile gloves is still gathering momentum.

- 贺特佳的产品主要是出售到美国,德国,和日本等高素质需求市场。

- 关民亮披露,美国销量贡献55%,欧洲国家也有33%,亚太区则占8%。此外,手套销量的76%比重是源于保健领域,食品业也在贡献5%。

- 他指出,新兴国家每年人均手套使用量只是2.3只。可是,美国的每年人均手套使用量却高达141只,欧洲国家和日本也分别有100只以及60只,与新兴国家形成强烈的对比。

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=21 #411 发表于 2011-12-5 小番薯

- Right now, Hartalega supplies 17 per cent of the world's demand of 45 billion pieces of nitrile gloves per year.

- Since the last quarter of 2010, Hartalega has experienced keen competition from Top Glove Corp Bhd, Supermax Corp Bhd, Kossan Resources Industries Bhd and Latexx Partners Bhd as they switch more of their production lines to make nitrile gloves. Many of them have also started to step up mechanisation of their production lines. Machines from China are being fitted in to accelerate their lines to run at 26,000 pieces of gloves per hour.

- Asked if he is anxious of the competition hotting up, Kuan smiled.

Currently, Hartalega is the world's only rubber glovemaker that has fully automated its stripping and packing lines. Still, it is not one to rest on its laurels.

- “丁腈手套需求前景穩定,天然膠的乳膠價增長聲中,這類輕便耐用手套逐步取代天然膠手套,天然膠與丁腈手套銷售量比例,已從前年的69%:31%,轉移至58%:42%。”

- Demand for nitrile gloves

remains robust at 15-20% p.a. (vs. 8% for latex). We believe the new

capacities (11b pcs p.a. by Top 6 in 2012) will be absorbed by the new

global demand of c.15b pcs p.a., but price competition is inevitable as

glove-makers rush to fill capacities.

(Maybank IB July.2012 - FY2013)

- we do not expect a price war from the second half of 2012, as claimed by certain quarters as global demand growth continues to outpace growth in industry capacity. We anticipate demand growth for nitrile gloves should be sustainable at 20% annually for the

mid term. To meet the increasing export demands of nitrile gloves, our new plant, namely

Plant 6, have begun construction in February 2012 with its first production line targeted to

commence operations in September 2012. Plant 6 will commission 10 production lines in total and is expected to give at least a 30% boost to our production capacity which translates to a further 3.5 billion pieces per annum. The construction of the 10 production lines in Plant 6 is expected to be fully completed in June 2013.

(Harta Q1.2013 Quarter report)

- Despite the nitrile glove supply influx by its competitors, Hartalega remains unfazed as it is supplying 17 per cent of the world's demand of 45 billion pieces of nitrile gloves per year.

http://www.btimes.com.my/Current_News/BTIMES/articles/hlega/Article/ (Aug.2012 - FY2013)

- Demand for nitrile gloves will remain firm in the medium term (2011: +29% YoY) in view of strong demand from Europe, where nitrile gloves hold a 35% share of the glove market (US: 70%).

(Maybank IB Aug.2012 - FY2013)

- We(CIMB analyst) understand that

Hartalega's operations in India and

China are picking up. The company

is planning five exhibitions in India

in Oct 12 and 10 in China this year.

We gather from our meeting that

glove consumption in India and

China may be higher than what

published stats suggest as a large

portion of glove usage in these

markets is off-the-books.

(CIMB research Sept.2012 - FY2013)

Today

our installed capacity exceeds 13 billion pieces

of gloves per annum, giving us the leverage to

supply approximately 23% of the global demand

for nitrile gloves which comprises 56 billion

pieces per annum.

- Annual report 2013

- In 2Q12, Malaysia’s export of synthetic

gloves was at a historical high of 9.4b pcs (+19% QoQ, +9% YoY),

driven by the demand switch in the US and Europe to the lower-priced

nitrile gloves. The split between latex and nitrile glove sales in the

global glove market is around 70:30, implying more room for growth

innitrile glove sales.

(Maybank IB Oct.2012 - FY2013)

- 据分析员了解,中国人均手套使用量极低,相对美国的149.3只,中国仅4.8只;而且对价格敏感对极高。

- 回顾历史,过去3度爆发传染病,即2003年SARS病毒、2007年H5N1流感和2009年的H1N1流感,全球手套需求当年扬升介于11%至24%。尽管H7N9的致命率约36%,较H5N1的60%来得低,但依然高于H1N1病毒的21%。基于H7N9病毒仍有不少未知数,分析员相信这病毒仍可能成为威胁。

http://www.nanyang.com.my/node/556287 (Aug.2013 - FY2014)

- 关民亮说,当前新兴市场的人均手套消费只有5只,相较于美国的140只以及欧洲的100只。「因此,我们早前已分別在中国和印度两国建立子公司。我们相信新兴市场將会是未来的成长所在,故我们也正对此作好准备。」他补充,一旦新兴市场在卫生与保健方面的意识获得提升,当地的手套消费量也將跟著同步走高。

http://www.orientaldaily.com.my/~oriental/index.php?option=com_k2&view=item&id=71186:15&Itemid=198 (Aug.2013 - FY2014)

- For the FY2013 ended 31March, the US group was the group's largest market with 59% of its nitrile gloves exported to the country. Additionally, sales to the US market also grew to a record high of 5.4billion pieces during the period, up 28% from FY12.

http://www.theedgemalaysia.com/in-the-edge-financial-daily-today/251993-hartalega-not-benefiting-from-weakening-ringgit-.html (Aug.2013 - FY2014)

Hartalega currently exports to 39 countries across five continents, namely Americas, Asia, Europe, Australia and Africa.

http://www.thesundaily.my/news/808547 (Aug.2013 - FY2014)

- 以丁腈手套为本的贺特佳,计划在其他手套领域寻求净利来源,如牙科及外科手套,这料将具强劲需求及提供较高的赚幅。虽然这些新业务在初步时的贡献不大,但分析员对这些发展感到正面,因将为公司的赚幅持稳。

http://www.nanyang.com/node/567169?tid=462target=_(Sept.2013 - FY2014)

- We understand that demand for nitrile gloves from Harta’s 45 major customers

(mainly from the USA’s and Japan’s renowned hospitals) remain strong. To cater

to the strong demand, Plant 6 was completed recently, and is currently running at

an average utilization rate of 88%, producing 330m pieces of gloves/month. This

brings Harta’s total production capacity to 14bn pcs (a step-up from 11bn pcs in

FY03/13).

(Affin Sept.2013 - FY2014)

- Interestingly, we note that Hartalega has increased its latex

glove sales from 5% to 10% QoQ as it secured new accounts in

Brazil. Latin America now accounts for 6.6% of total revenue

(1QFY14: 3.5%).

(Am research Nov.2013 - FY2014)

- He(Kuan Kam Hon) also noted that for the first time, the nitrile gloves segment had taken the lead and surpassed natural rubber with a demand ratio of 51% to 49%. “Although European importers must now pay 2% to 2.7% for glove imports from Malaysia, the fact that nitrile glove exports from Malaysia to the European Union increased by 30.3% in 2013 clearly indicates the robust demand for nitrile,” Kuan said.

Despite some of these cost increases and contraction in margins on strong competition, the company, which presently supplies 14% of the global demand of nitrile gloves, is still able to hold on to a price premium in the nitrile glove segment.

http://www.thestar.com.my/Business/Business-News/2014/08/05/Nitrile-gloves-demand-robust-Hartalega-Industry-set-for-growth-on-rising-healthcare-concerns/ (Aug.2014 - FY2015)

- Hartelaga's geographical contributions have expanded further in Japan and emerging markets such as Brazil, in line with its plan to continuously seek new opportunities from its current portfolio.

- In July, the group relaunched its OBM strategy, renaming its distributor company Pharmatex (original name: Mun). Its Pharmatex brand products have also been rebranded as Glove-On, which will serve as the umbrella brand for all the sub-brands of the group's OBM products.

http://www.theedgemalaysia.com/business-news/301655-new-complex-to-boost-hartalegas-earnings.html Aug.2014 - FY 2015

- 關民亮指出,賀特佳手套幾乎都是出口,目前市占率為12%,在手套製造中心開始投產時,將大大提高公司產量。

- 新興市場不斷在成長,並開始著重醫療領域,賀特佳也開始會著重新興市場的發展,目前該公司已進入中國和印度市場。

- 他指出,該公司將通過品牌重塑計劃,打造出屬于自己的品牌,並開始在新興市場推售。“我們會專注在新興市場,但目前中國和印度業務的營業額佔公司總比例會是非常小的。”他指出,目前,中國業務銷量為1200萬令吉,放眼成長至2000萬令吉。印度業務則在去年方才開始營運,因此貢獻會是十分小的。

http://www.chinapress.com.my/node/555207 Aug.2014 - FY 2015

He cited the Malaysian Rubber Gloves Manufacturers Association announcement that rubber glove exports, particularly for the healthcare, food, electric/electronics and automotive sectors will continue to rise by eight per cent to 178.6 billion pieces at the end of this year.

http://www.nst.com.my/node/27033 Aug.2014 - FY 2015

Management expects its installed capacity to progessively reach 22bn by FY16 (Mar) (from 14bn in FY14). The contribution may not be significant as the lines are being installed in stages. Upon completion of its NGC plants, Hartalega’s total installed capacity could reach 42bn pieces per annum by 2020.

(RHBOSK Research Nov.2014 - FY2015)

Business

- 賀達麗嘉合成橡膠及天然橡膠手套銷量各為和65%及35%,前者銷量幾乎是同業的2倍。相較天然橡膠價格的劇烈波動,合成橡膠原料價格偏穩,成本易于掌控。

- 关锦安接受《星报》访问时也曾表示:“我们的赚幅非源自于高价格售卖丁腈手套,关键在生产效率。”贺特佳董事经理关民亮认为,大马手套领域已失去劳工成本低廉的竞争优势,取而代之的是自动化。因此他建议,手套业者应探索创新之路,以减缓成本高涨的影响,所以投资在科技是关键之举。

- 2005年,贺特佳率先推出全球首个重4.7克的丁腈手套,然而在2007年却被竞争者捷足先登,推出更轻的4.2克的丁腈手套。尽管如此,贺特佳并没有却步,随即推出全球首个3.7克的丁腈手套作为“回应”。值得一提的是,这也是世界首个无粉的聚合物涂层天然橡胶手套。事实上,该公司早前在推出4.7克的丁腈手套时,已一并研发此3.7克的丁腈手套,惟当时并没有打算立刻推出市场,仅计划将其作为“备用子弹”,待必要时才拿出此撒手锏。最后,贺特佳成功于2011年推出仅重3.2克的丁腈手套,销量也在7年内翻倍增加59倍,奠定该公司在全球丁腈手套市场地位。

Hartalega has earned its name as the world’s fastest glovemaker by investing big time in fully automating its production lines.

Kuan and his team of mechanical engineers have cranked up their new production lines to run at a breakneck speed of nearly 50,000 pieces of gloves per hour while the industry average is still lagging behind at 26,000 pieces per hour.

Hartalega’s factories are now able to churn out 12.2 billion gloves

a year and these are shipped to

more than 40 countries. This translates to Hartalega having a 16 per cent grip on the world’s demand of some 75 billion pieces of nitrile gloves a year.

Malaysian glove-maker

Hartalega Holdings Bhd has launched a new distribution arm, MUN, which it plans

to develop into a global healthcare products company to expand its brand

presence in key markets. The launch of MUN also marked the rebranding of the

group’s subsidiary, Pharmatex. The unit, with its operations in Australia,

China, India and the US, will now be integrated into MUN, the group said in a

statement today.

“The establishment of

MUN will allow us to enhance our distribution channels in an integrated manner

and standardize operations, building an even stronger foundation to extend our

current reach. In the long-term, we aim to develop MUN as a global healthcare

products company, offering gloves as well as other products to meet the needs

of the healthcare industry,” said the group’s managing director, Kuan Mun

Leong.

“As the global

distribution platform for Hartalega, MUN will be able to leverage on the

Group’s competitive advantages as an industry pioneer, along with our

reputation for top-of-the-line products,” he added.

In conjunction with MUN’s

launch, the world’s largest nitrile gloves maker also announced the creation of

GloveOn, a new umbrella brand to represent its existing glove business. The new

brand would allow MUN to diversify into other medical products by

differentiating the medical distribution company from its parent company’s

products, said the group.

The establishment of MUN would also complement Hartalega’s long-term

expansion strategy, namely the NGC, which comprises six manufacturing plants

and 72 production lines.

Cost/Pricing

- 關錦安說,勞力資本不是公司的首要考量,因此暫無到其他人力成本低廉的區域國家設廠。

- 05財年,該公司人力成本佔總營業額12.4%,07財年時減至8%,冀未來2年下滑到7%。

- 關錦安一再重申,公司生產成本及銷售皆以美元交易,自然護盤策略下美元貶值衝擊不大。

- 相較天然橡膠價格的劇烈波動,合成橡膠原料價格偏穩,成本易于掌控。

- 馬銀行說,美元兌馬幣若走貶10%,將導致淨利下挫3%,倘若能未來兩個季度把美元走弱效應管控好,而不衝擊其淨利,將有推高股價之效

刚刚出席了Harta AGM, 根据老板的说法:

-- 天然胶手套贵过人造胶手套大概10%,低蛋白的天然胶手套会比普通天然胶手套贵2-3美元

- 詢及美元走疲影響,公司董事經理關錦安解釋鑒於丁晴手套原料是以美元購買,型成自然護盤,有助緩和外匯風險,不會對淨利造成太大衝擊。

- 關錦安指出:“丁晴手套25%的高賺幅已引來很多新業者進駐,賺幅或會收窄至23.5%。”

- 丁晴手套佔賀特佳產能的80%,其他則是乳膠手套,賀特佳僅有50%盈利會受令吉及美元匯率影響,因生產成本中,丁晴膠佔50%,這些皆以美元計價,只有營運、人力成本、賺幅及股息需兌換令吉。關民敬說:“但乳膠手套商卻不一樣,極受匯價波動影響。”

- 目前因乳膠價格高企于每公斤7令吉水平,每盒乳膠手套(1000只)價格較丁晴手套來得高,約120令吉,每盒丁晴手套則是112令吉。

“雖然手套商可轉移成本,但大多訂單都是合約性質,買家尋求穩定價格。原料成本較乳膠手套來得穩定,是丁晴手套商的一大優勢。

- 隨著積極研發及提高自動化手套生產,目前公司成功將人力成本減至7.7%。

- 关民敬还说,集团50%的原料都有护盘,因此令吉走强不会对集团造成严重影响。

- 关民亮则表示,丁晴手套价格相对天然胶手套稳定,很多买家倾向购买丁晴手套。

- 丁晴人造胶手套赚幅好,加上不会引起使用者对橡胶中的蛋白质敏感这个优点,成长潜能比天然胶手套高。几年前,曾是手套业霸主的 Kimberly-Clark 宣布完全退出天然胶手套市场而专注于生产丁晴人造胶手套,就是为了要维持较高的营业赚幅。

Nitrile gloves are now up to 30% cheaper than latex gloves, an unforeseen, atypical trend in the past. This is due to continued escalation in latex costs (+60% year-on-year) vis-à-vis synthetic rubber (a major material cost for nitrile gloves; +28% y-o-y). The price disparity favouring nitrile demand, which is evident in the US and European markets, is set to catch up in the emerging markets (Asia, Latin America).

- 此外,該行也預測丁晴價格至4月份為止,將穩定在每公噸1千400至1千500美元,為賀特佳這類型的丁晴手套製造商帶來優勢,公司管理層指出,鑒於天然膠價格漲勢,以丁晴手套代替膠手套的轉變趨勢目前仍持續中。

- 贺特佳是我国最大的丁晴手套制造业者,分析员预计,丁晴原料价格每提高10%,将促使贺特佳的每股盈利遭侵蚀介于5%至7%。

- 联昌国际研究分析员在一份报告指出,尽管丁腈的原料供应包括大马、新加坡和韩国,且我国主要丁晴手套制造业者的原料供应大部分来自国内和韩国,原料供应估计不会受到日本地震的影响。但是,分析员表示,丁腈属于全球产品,而其主要原料为丁二烯(butadiene),属于上市交易的商品,因此,日本地震可能影响该商品价格。值得关注的是,日本瑞翁(NIPPON ZEON)是手套领域的丁腈原料主要供应商,而贺特佳在有20%至30%的丁腈是向该公司采购。

"I would like to go on the record that we're receiving steady supply of nitrile latex from our suppliers in Japan. Their factories are in Kawasaki, far away from the area hit by the earthquake and tsunami."Kuan Kam Hon said

- 日本主要丁晴橡膠供應商日本瑞翁(NIPPON ZEON)週二在其網站公佈,儘管其生產設施沒有遭受破壞及營運正常,但其原料供應狀況因電流中斷而不穩定,產品供應可能受嚴重堵車及艱困物流狀況的影響。但產品供應可能受短暫影響。

- 根據聯昌研究敏感度分析估計,丁晴橡膠價格每上調10%,賀特佳2011至2013財政年每股凈利將調降估計達5至7%。

- With the natural butadiene rubber (NBR) price spiking 10% month-on-month in April, the market has shifted its preference to latex-focused glovemakers, relegating Hartalega to a lower position.

- Nevertheless, we believe that the prospects for nitrile gloves remain promising as nitrile gloves’ average selling price (ASP) is still 20% to 30% lower than latex powder-free gloves.

- The rise in NBR price, coupled with the market supply overhang, will cause Hartalega’s margins to decline. However, we think this is just a short-term blip as: (i) the NBR price spike was due to rubber consumers’ unwarranted switch from natural rubber (NR) to NBR with the consumption pattern to revert once the NR price falls in May (after the “wintering season”); and (ii) demand for nitrile gloves from the emerging markets which will catch up with the incoming nitrile supply.

- After raising nitrile gloves ASP by 1% recently to reflect the higher NBR cost, Hartalega’s nitrile gloves ASP is still a huge 23% discount to Top Glove Corp Bhd’s latex powder-free (PF) glove. As an indication, to close the ASP gap between nitrile and PF gloves, latex costs have to plunge by more than 55% to below RM5 per kg (from RM10.90 per kg now). This is also lower than the floor rate (about RM7.50 per kg) set by the rubber producing consortium.

丁月青價格偏高是隱憂之一。截至本月11日與14日,Synthomer與Polymer Latex公司,將丁月青價格上修15至16%,或每公噸280美元。

- On 11 and 14 April, Synthomer Ltd and Polymer Latex raised

the prices of nitrile latex sold to the glove dipping industry worldwide by US$280 per

metric tonne, which works out to a 15-16% increase. Synthomer said that the price

increase was required as the cost of monomers used in the production of nitrile had

risen dramatically. Synthomer’s price increase follows price hikes by Polymer Latex in

March (US$160 per metric tonne) and Zeon Europe GmbH in April (€150 per metric

tonne). The higher prices are within our expectations as crude oil prices have risen by

30% YTD (Figure 2).

[CIMB Research April.2011 - FY2011]

- 联昌银行研究分析员表示,手套制造商最大的支出是天然橡胶和丁腈橡胶,占总成本的47%至69%,而电费仅占1%至4%。所以电费涨价,对大部分制造商影响不大。“电费若涨10%,仅削减2012财年每股盈利的0.4%至3.1%。” 根据报告,稳大(Adventa,7191,主板工业产品股)电费占成本3.5%,故将承受每股盈利下挫3.1%的影响,也是行内遭到最大影响的业者。虽然贺特佳(Harta,5168,主板工业产品股)电费占成本也是3.5%,但基于税前盈利为全行最高(33.4%),足以抵消电费上调的冲击,分析员认为每股盈利只会微降0.7%。另外,利得股份(Latexx,7064,主板工业产品股)每股盈利料减0.4%,因为电费成本仅1%,是影响最少的业者。“

http://www.nanyang.com/node/324516 (May.2011 - FY2012)

- Effective today, the government raised electricity rates by 7 per cent.

There is also a 20 per cent price hike for natural gas across

industries. The last time the government raised gas prices was in August 2008 by a

hefty 72 per cent to RM22 per mmBtu from RM12.80 per mmBtu. After much complaints, the government, in March 2009, lowered the gas tariffs by 30 per cent to RM15.35 per mmBtu.

- From today, however, rubber glove manufacturers using less than 2mmscfd

will need to pay the new rate of RM16.07 per mmBtu. This is 7 per cent

more than the old RM15.00 per mmBtu rate.

- Fiona Leong of Citi Investment Reseach is keeping her earnings forecasts

for glovemakers unchanged because the

20 per cent gas price hike would

only raise operating costs by 0.7 per cent, if there is no cost pass

through.

http://www.btimes.com.my/Current_News/BTIMES/articles/gloov/Article/print_html (May.2011 - FY2012)

- Although nitrile costs have risen in the past six months, nitrile gloves

remain relatively cheaper than latex gloves due to the persistently

high latex costs. This pricing gap will continue to create strong demand

for nitrile gloves. Hartalega’s FY11 (FYE March) net profit of RM190

million (+33% year-on-year) has closed its gap with Top Glove.

http://www.theedgemalaysia.com/in-the-financial-daily/188290-hartalegas-nitrile-gloves-outpacing-latex.html (June.2011 - FY2012)

- 乳膠及丁晴手套的平均售價差距已大幅減縮,因乳膠成本走跌,而丁二烯橡膠成本則攀升;現有的手套掛價仍然偏向丁晴手套的銷售,丁晴手套平均售價比無粉乳膠手套低10%左右,比有粉乳膠手套則不相上下或稍微偏高。

-

乳膠價格自橡膠樹落葉期過後,在6月份已顯著滑落至目前的每公斤8令吉60仙,比3月份的高峰期下瀉20%。乳膠產量的改善,手套生產商預見乳膠價格在今年下半年徘徊於每公斤7令吉左右。與此同時,

丁二烯橡膠成本在近月則大幅挺漲,4月按月猛彈10%,5月更躍升15%,6月起3%,歸因於原油價格的高企(原油副產品為丁二烯橡膠原料)。

-

丁二烯橡膠價格波動一般落後原油價格2至3個月,原油價格自今年5月份以來已走跌,因此,預料丁二烯橡膠價格也將步其後塵。

http://biz.sinchew.com.my/node/49471 (July.2011 - FY2012)

- Though the cost of NBR (nitrile butadiene rubber) has gone up 27% q-o-q,

margins may see only a minor contraction of around one percentage point

(pps) as management partially passed on the higher cost and the company

reaped efficiency gains from its new Plant No 5. Additionally, earnings

may appear unscathed by the weaker US dollar due to its favourable

hedging policy.

-The ongoing switch to nitrile gloves from latex is aggressive. Europe

now accounts for 21% of Hartalega’s overall sales from 15% in 2HFY11.

Although NBR price is at its high of US$2.08 per kg (54% increase YTD),

Hartalega’s nitrile glove average selling price (ASP) remains

competitive at around a 30% discount to latex powder free.

http://www.theedgemalaysia.com/in-the-financial-daily/190958-hartalega-likely-to-outperform-but-shares-flat.html (August.2011 - FY2012)

- “The switching from Natural Rubber to Nitrile glove has gathered

momentum in Europe and demand is growing rapidly. Europe now accounts

for 28% of Hartalega’s overall sales from 18% compared with the same

quarter last year.

http://www.theedgemalaysia.com/business/190994-hartelega-1q-net-profit-up-32-to-rm5477m.html (Aug.2011 - FY2011)

- It said on Tuesday that with the sharp increase in nitrile material price and recent high volatility of US dollar, challenging time is ahead.

http://www.theedgemalaysia.com/mobile/article.php?id=195817 (Nov.2011 - FY2012)

- Hartalega said the inventory level has increased from RM64.7 million as at March 31, 2011 to RM114.5 million as at Sept 30, 2011 due to increase in raw material prices and also as a result of the group’s stocking up of raw materials. “The group targets to keep higher inventories to reduce pressure on meeting growing sales demand,” it said.

http://www.theedgemalaysia.com/mobile/article.php?id=195817 (Nov.2011 - FY2012)

- The price of its key input, NBR, has fallen sharply by 18% month-on-month to US$1.70 per kg and is 11% cheaper than latex now. However, we do not expect significant margin improvement in the sequential quarters, for management would likely defend market share via a competitive average selling price, in view of the new capacity-led competition in the nitrile segment. Separately, sales of nitrile gloves remain strong in Europe, for they are still 10% to 20% cheaper than latex PF gloves.

http://www.theedgemalaysia.com/mobile/article.php?id=195844 (Nov.2011 - FY2012)

- 全球最大合成丁月青膠乳供應商Synthomer公司宣佈,將額外斥資1億1000萬令吉,在大馬擴充其巴西古當工廠,打造全球最大的丁月青膠乳工廠。敲定這筆收購之後,Synthomer已將巴西古當工廠視為亞洲區域的樞紐,亦成為整個區域的單一貨源,讓Synthomer能夠更貼近客戶。

- Synthomer至今估計已經在柔佛工廠投入2億5000萬令吉。在最新的全球性科技加持下,該公司確認初步產能已經達到每年10萬噸,以滿足全球和本地需求。

- Synthomer的擴充行動是為了確保產品持續擁有良好的素質。但建廠的最主要原因,仍是為了應付市場對醫療體檢和工業手套對丁月青膠乳日益增加的需求。

- 今年初,Synthomer順利完成柔佛居鑾工廠的第5階段建設工程,到了2013年,居鑾和巴西古當的年產能將是30萬噸。

http://www2.orientaldaily.com.my ... w2G1ZW72dgg15mV0RK7 (Dec.2011 - FY2012)

- 在丁月青價格下跌35%的同時,天然樹膠價格卻上漲17%,這使到丁月青手套的需求改善。同時,歐盟削減醫療預算,價格相對較低的丁月青手套將成為首選,這些消息對以生產丁月青手套為主的賀特佳而言,屬正面消息。相較天然樹膠手套,丁月青手套的成本已降低20%。兩者之間的差價雖在2011年8月扳平,但最新的數據顯示丁月青的成本進一步走低。與去年3月的高峰期相比,丁月青價格已降低高達40%。同時,丁月青和天然樹膠的價格差距越大,越有利於賀特佳,讓該公司能夠從天然樹膠手套業者手中爭取市占率。

- 另外,歐盟將削減其醫療預算,並鼓勵醫院尋求更為廉價的代替品。其實丁月青價格與布倫特原油價格有密切關係,聯昌國際分析員認為,由於地緣政治不穩定,原油與丁月青的價格將持穩,從2011年中期至今分別下跌15%及35%。由於目前丁月青手套的生產成本較天然樹膠便宜20%,因此料可吸引更多的需求。

http://www2.orientaldaily.com.my ... OpK08zb1t362HEq8gCb (Jan.2012 - FY2012)

- Latex prices have increased

by 16% to RM7.43/kg from a one-year low last month. This is due to:

(i)

the wintering season which reduces latex yields; and

(ii) the Thai

government’s efforts to support rubber prices by having a USD480m

budget in place to buy 200,000 tonnes of unsmoked rubber sheets.

The

wintering season typically ends in May, and with the China auto market

still growing (albeit at a slower pace of +10% YoY), the supply of rubber

relative to demand will likely be in a deficit position again this year.

[Maybank IB Feb.2012 - FY2012]

- 國內手套商加碼增產丁手套,下半年或為搶銷量掀價格戰,繼而拖低賺幅,加上最低基薪制落實在即,員工薪資成本至少增11%至15%,業者營運前路壓力重重。“賀特佳(HARTA,5168,主要板工業)和速伯瑪(SUPERMX,7106,主要板工業)已表明會以價格策略大力推銷丁手套,其余2名業者料將緊追趨勢。”

- 即將实施的最低薪金制,短期將会衝击手套业者的净利,但长期则会带来正面效应。此外,对大型手套业者而言,当小型业者无法吸收工资成本上涨而被淘汰时,可趁机提升市占率。週二,手套股大部分下跌。

- 我国首相纳吉预定在4月30日,作出最低薪金制的宣布。政府或在未来6至12月的时间內实施有关政策,市场预测最低月薪范围介于700令吉至1000令吉。分析员假设,最低月薪为1000令吉、所有员工薪资相等,胶手套製造商的净利將下跌2%-8.9%。若这1000令吉已涵盖额外支付,业者的净利则会降低1.2%-6.1%。

- 分析员相信,为了减轻最低薪金的影响,手套业者將尝试,第一、价格转嫁给客户;第二、减少各项开支;第三、逐步实施最低薪金制;第四、提高厂房科技。

- 目前,外籍勞工共佔該公司總雇員人數約67%。

- "Nitrile gloves are currently selling at US$32 (RM96) per 1,000 pieces. It is likely to come down to around US$30 (RM90) in the immediate months.

- "We expect butadiene price to come down further because suppliers in China, Japan, South Korea and Taiwan have cut back on their production output, given bearish market sentiment," Kuan told reporters after a shareholders' meeting here yesterday.

- According to authoritative chemical industry journal ICIS, global demand for butadiene is around 11 million tonnes per year. The petroleum derivative is now selling for US$2,800 (RM8,400) per tonne.

- 由于丁晴手套(Nitrile)現金成本比天然膠手套低25%,市場需求穩定,賀特佳預期2012年丁晴手套需求將提高至20%,天然膠手套則是8%。

- The price of latex has fallen by

17% (from its peak in Feb 2012) to MYR6.50/kg and undershot the

Thailand government’s floor price of MYR7.40/kg. The latest mulling of

initiatives (limiting rubber exports) by a Thailand-Malaysia-Indonesia

government tripartite to support latex price and fight market forces will

prove futile again, in our view, given that the underlying reason for the

decline is a supply surplus situation with market forces to reign.

- Despite the fall in latex prices, the

price of NBR (nitrile butadiene rubber, primary raw material for nitrile

gloves) has also plunged by 28% from its peak in Apr 2012 and is

currently still about 17% cheaper than latex. Nitrile gloves are therefore

still more economically competitive at this stage.

- Glove makers,

however, have been unwilling to price nitrile gloves at a discount to

powder free gloves given potential cannibalization, thus margins for the

former are much better, given lower production costs.

(Maybank IB July.2012 - FY2013)

- According to our channel checks, the

implementation of the minimum wage hike (+20-25%) may be delayed

to Jul 2013 (supposedly Jan 2013). This will give Top Glove more time

to upgrade the automation of its existing plants (target completion by

early 2013) and mitigate the wage hikes. Regardless, as the impact is

industry-wide, we believe higher cost will be passed on. Labour

accounts for 8-10% of total production costs.

- 请问一下,那个关于currency forward contract的,具体的操作是如何,去年开始

>>有些公司会在接到order或者在发出invoice的时候,为了锁定盈利,就会卖空美元(等同order或invoice数目),酱美元过后的波动就不会影响盈利。

可是在结账日的时候如果美元大涨,因为之前卖空美元,公司的账目就会面对外汇亏损,不过这只是一个短期的影响。(loss on forward currency contract)

>>有些公司会在接到order的时候,就会开始锁定外汇,原料价钱和数量,。。。为了就是要有一个比较肯定的盈利。他们不想在这单生意完成和收钱的时候,因为外来的因数而影响到他的盈利。

。比如有一些发展商在卖屋子的时候,就已经和洋灰和铁条供应商签好原料的价钱。

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=38 #746

- Though the company has lowered the ASP of its nitrile gloves to USD30/’000pcs (-10% QoQ), this is still less than the 21% QoQ drop in NBR cost. Hence, we think margins in subsequent quarters should at least stay at current levels.

(Maybank IB Aug.2012 - FY2013)

- 如果它买原料用的是美元,收钱也是美元,就不会有账面亏损了。可是它还会卖空美元吗(看死美元大跌)?

原料大概只是占了revenue的40%左右,这一部分有自然对冲,应该不需要卖空,卖空应该是另外的60%。

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=40 #787

- Although latex price has pulled back by 9.4% since peaking at RM10.9/kg on 8 April 2011, the group’s EBIT and PBT margins shrank 4ppts and 2ppts

respectively owing to price competition in the nitrile glove segment. In order to fulfill the

strong demand for nitrile gloves, all four major glove players had ramped up their

respective production capacity. We believe this may spark off a price war and pressure

glove makers’ profit margins going forward. We gather that management will be more

aggressive in pricing its nitrile gloves going forward in order to maintain its lion’s share in

this market.

(OSK research Aug.2012 - FY2013)

- MIDF证券研究行机构表示,由于全球经济放缓,导致丁二烯的价格下调,该原料是丁腈与天然胶乳的主要成分。它补充:“由于丁腈乳胶和天然乳胶分别占该集团总生产成本的45%和5%,因此我们预期丁二烯和天然胶乳价格疲弱,将会提高它的盈利能力。”

http://www.kwongwah.com.my/not_found.php?r=/index.php?view_type=news&date=20120808&id=140 (Aug.2012 - FY2013)

- "We expect the butadiene price to come down further from the current US$1,400 a tonne. That means glove prices are likely to fall. We'll pass on the savings to our clients," said managing director Kuan Kam Hon.

http://www.btimes.com.my/Current_News/BTIMES/articles/hlega14/Article/index_html (Aug.2012 - FY2013)

- 尽管油价上涨,但却不会对Harta带来直接冲击,因为该公司主要产品丁青手套原料为制作轮胎的丁二烯(butadiene),为石化半成品之一。换句话说,Harta原料成本受汽车领域好坏所主导,而汽车领域目前因为经济衰退而变现不佳,这对Harta仍属一项利好消息。关氏相信丁青行情在未来数个月将能维持在目前没公吨1300至1400美元,而其走势主要视天然胶价格而定。

(Busy weekly 24.9.2012)

- "The slump in nitrile price is probably attributable to the continued lacklustre performance of the automotive industry in China as tyre manufacturing consumes 70 per cent of global rubber supply. "The easing of raw material prices, which is 50 to 60 per cent of the manufacturing costs, bodes well for Hartalega to protect its market leading margin," JF Apex Securities Bhd said in a research note today.

http://www.btimes.com.my/articles/20121029141933/Article/ (Oct.2012 - FY2013)

- NBR’s price discount to latex has

widened to 12% (vs. a 2% premium in Aug 2012) as NBR prices fell (-

6% in the last two months) while latex prices rebounded (+7% in 2-

month). Presently, the ASP of premium quality nitrile gloves is on par to

similar quality latex powder-free gloves, ensuring the competitiveness

of nitrile gloves.

-

- We estimate that the new minimum wage of MYR900/month will

result in a total cost increase of MYR8m p.a. for Hartalega (or a 1%

increase in total production cost), as labour accounts for 11% of

Hartalega’s total production cost.

-

- Two scheduled bi-annual MYR6/mmbtu gas price hikes were

missed (Dec 2011 and Jun 2012) and the government is likely to

delay another scheduled gas price hike in Dec 2012. The total

quantum of the delayed gas price increases will amount

MYR18/mmbtu (+120% from the current gas price of

MYR15/mmbtu) by Dec 2012. We believe the government will

phase out gas price hikes in 2013, and not implement a steep rise

in gas prices. Assuming a 120% increase in gas prices, we

estimate that Hartalega will experience a 10% rise in total costs.

Note that gas accounts for 8% of Hartalega’s total production cost.

(Maybank IB Oct.2012 - FY2013)

- 1H revenue rose by 12% yoy to

RM503m as utilisation hit 90%

(1H12: 82%) due to strong demand.

Total gloves sold in 1H rose by 20%

to 4.7bn pieces, offsetting a 6.5%

decline in blended selling prices to

RM107/1k pieces. The higher output

drove 1H EBITDA 11% higher to

RM161m on stable margins. Core net

profit rose by 8% to RM113m.

(CIMB research Nov.2012 - FY2013)

- 安联研究分析员预测,丁月青手套在今年11月仍得以享有比天然胶超过10%成本优势,他相信,天然胶手套只能在胶乳价格跌破每公斤5令吉,才能恢復价格竞爭力,但这料不会在未来12个月出现。

http://www.orientaldaily.com.my/index.php?option=com_k2&view=item&id=30422:&Itemid=198 (Nov.2012 - FY2013)

- 豐隆研究則說,丁腈膠價格依然低於天然膠,丁腈價目前約每公斤4令吉22仙,乳膠則為5令吉60仙,不過,受丁腈價格回跌影響,丁腈手套平均售價也按年下滑9%至每千隻手套105令吉,管理層預計丁腈手套需求將在中期內保持20%成長。

http://biz.sinchew.com.my/node/67000 (Nov.2012 - FY2013)

- NBR prices have inched up to

USD1.39/kg (+5% MoM, -12% YoY) in Feb 2013, having been stable

for the past five months. We believe that NBR prices could still be on a

rising trend in the near term, as they track the rise in prices of other

commodities (i.e. crude oil, natural rubber).

- That said, we think that Hartalega will

pass on the higher NBR costs, given that price competition is almost

unheard of at this juncture. As an indication, Hartalega has raised its

nitrile glove ASPs by 2-3% in Feb 2013 in order to pass on the full

quantum of the minimum wage hike.

(Maybank IB Feb.2013 - FY2013)

- Additionally,

Hartalega also benefits from savings which arise as a result of the

shifting of the foreign workers levy (MYR1,200/each) back to the

employees. This alone could see a marginal 1% (MYR4m p.a.)

enhancement to Hartalega’s bottom line. It has also passed on the full

quantum of the minimum wage hike which became effective in Jan

2013.

(Maybank IB Feb.2013 - FY2013)

- The impact of minimum wage implementation on labour cost has been passed through to the customers by the increase in ASPs by 2-3%.

(HongLeong IB Feb.2013 - FY2013)

- 黃氏唯高達研究指出,賀特佳銷售量按季成長8%,因第6號工廠投產,令產能增加,丁腈原料成本按季放後緩4%至平均每公斤1.33美元,但丁腈手套每盒售價降低至33美元(第二季為35美元)。

http://biz.sinchew.com.my/node/69888 (Feb.2013 - FY2013)

- “產品售價在過去12個月下滑了9%,相信是基於原料價格走低的關係,而非產能過剩。"

聯昌研究表示,該公司每個月2次就會根據成本、需求與匯率的變動來制定售價,而丁晴原料價格在過去12個月中下降了24%,因此售價也有所降低。

- 儘管消息傳出與大馬氣体(GASMSIA,5209,主板貿服組)的新合約協商被展延,聯昌研究表示,有信心最終雙方會達成協議,因大馬氣體是全馬唯一的天然氣供應商,即使手套業者不滿意目前建議書,最終仍會同意。

http://biz.sinchew.com.my/node/72887 (April.2013 - FY2013)

- 其实除了胶价,丁青价格也呈跌。分析员称,丁青在3月的平均价格为每公吨1330美元,于2012年平均价格比较,下滑了9.5%。无庸置疑,原料价格下跌对手套业者而言是佳音,因为原料价格占手套业者整体营运的愈6成比重。胶价与丁青价齐跌,天然胶手套和合成胶手套业者都能从中受惠。

(Busy weekly #220 April.2013)

- However, the mismatch growth between sales and volume

was attributed to lower ASPs where NR glove ASP was

down by 16.6% yoy from RM145/k pcs to RM121/k pcs,

while nitrile glove ASP was down by 7.0% yoy from

RM110/k pcs to RM102.3/k pcs.

(HongLeong IB May.2013 - FY2013)

- MIDF研究說,丁腈手套佔全球40%需求,其餘60%為橡膠手套,惟未來將有20%轉向丁腈手套;兩種手套成本約佔賀特佳45%與5%成本,在原料價格持穩下,相信賀特佳可有令人印象深刻之表現。

http://www.orientaldaily.com.my/index.php?option=com_k2&view=item&id=54543:&Itemid=198 (May.2013 - FY2013)

- This is despite the government hinting of a reduction in fuel subsidies, hence higher gas prices in the foreseeable future. Currently, gas rates that are applicable to manufacturers like Hartalega are at around RM16 per million British thermal unit.

- "We have already factored in the prospects of higher fuel costs. We just hope that the fuel price hike would be somewhat reasonable and gradual so that we can pass it on to clients." said group managing director Kuan Mun Leong.

http://www.btimes.com.my/Current_News/BTIMES/articles/HARTAL/Article/print_html (June.2013 - FY2014)

- According to Alliance, nitrile gloves still enjoy latex cost advantage of more than 20% over NR gloves as of May 2013.

- “After taking into account the higher fuel cost for nitrile glove, we believe NR gloves will only be able to regain its price competitiveness, if latex price falls below RM4.50 per kg, which we think is unlikely given the potential intervention by governments of major producing countries that is Thailand, Malaysia and Indonesia.”

http://www.thestar.com.my/Business/Business-News/2013/06/18/Hartalega-to-emerge-as-industry-gamechanger-Alliance-also-favours-Ko.aspx (June.2013 - FY2014)

- 另外,虽然贺特佳最大的出口市场是美国,但其执行主席关锦安却认为该集团不会受益于近期的美元上涨趋势。他表示,该集团一般上是使用远期外匯合约来进行交易,以便对冲货幣匯率的波动。

- 在未来4个月內,我们或许会从美元的升值或令吉的贬值中受惠,但我们也无法知道这趋势会否持续下去。」

http://www.orientaldaily.com.my/~oriental/index.php?option=com_k2&view=item&id=71186:15&Itemid=198 (Aug.2013 - FY2014)

- Hartalega, which exports the majority of its nitrile gloves to the US, will not benefiting much from the current fall of the ringgit against the US dollar as it had already hedged its greenback six months earlier.

"The recent exchange rate will not benefit the company because we have sold off our US dollar in advance. That is to ensure we locked in our profit," chairman Kuan Kam Hon told reporters after Hartalega's AGM yesterday.

Kuan said the largest synthetic glove maker's normal practice is to hedge over its proceeds, and normally the hedges cover the preceding six months.

http://www.theedgemalaysia.com/in-the-edge-financial-daily-today/251993-hartalega-not-benefiting-from-weakening-ringgit-.html (Aug.2013 - FY2014)

“贺特佳产品是100%出口,结算货币是美元,但我们尚未感受到最近美元波动所带来的影响。”他解释,公司交易合约在4个月至6个月前定下,设定内容包括了美元的汇率。“我们不知道未来的趋势如何,如果美元持续走强,我们将会因此受惠。”“不过,我们目前没有因为汇率问题而受到财务上的影响。”

http://www.nanyang.com/node/559759?tid=462 (Aug.2013 - FY2014)

- 肯納格研究表示,政府最近重啟津貼合理化計劃,意味之後可能上調電費,惟該行不過度擔憂,因能源價僅佔總生產成本8至10%。政府自2011年6月上調天然氣價7%至每百萬英制熱值(mmbtu,單位)16令吉零7仙,之後原預定每6個月上調天然氣價8至10%,直到2015年為止,但自2011年12月評估後卻一直停頓。

- 馬幣兌美元走軟,短期內對膠手套業者有利,但長期影響中和,馬幣兌美元每貶值1%,膠手套淨利平均料增1%至2%。肯納格表示,馬幣走疲一般對手套業者的影響正面,主要是銷量由美元主導,馬幣兌美元走貶將帶動手套業者的營收,不過長期間,因手套業者一般對外匯護盤,利好因素或隨之抵消。

http://biz.sinchew.com.my/node/81634?tid=23 (Sept.2013 - FY2014)

- 一些出口商如以生产和出口丁腈手套为主的贺特佳,将不会从现有令吉兑美元走势趋软中获利。这是因为贺特佳已经对冲其美元,以保护其本身对负面货币动向的风险。其主席关锦安最近告诉记者,它已提前出售其美元赚益,以锁定其盈利。

http://www.eunited.com.my/?q=node/44639 (Sept.2013 - FY2014)

- 马银行投行分析员表示,不太担心供应扩增的问题。

- 根据新的全球丁腈手套需求预测,以及预计产能逐步增加,分析员相信手套业者新增的产量,只会在一开始时压低平均销售价而已。同时,目前的丁腈手套业者,如贺特佳(HARTA,5168,主板工业产品股)将会持续以营运效率挡开价格战,让公司能够维持其赚幅保持不变。

- 相比于树胶手套,丁腈手套的赚幅仍非常大,差价超过6%点。分析员指,虽然丁腈手套的原料成本较低,但是居于强劲需求,让丁腈手套可取得较高的售价。尽管丁腈平均销售价较高,但需求持续强劲增长,尤其是来自对价格较不敏感的发达国家的需求。此外,分析员相信需求将按年增20%。

http://www.nanyang.com/node/567169?tid=462target=_ (Sept.2013 - FY2014)

- 随着政府调高汽油价,导致公司面对较高的运输成本,不过,对业者造成的影响不大,因运输成本仅占总成本的2%至3%,而业者也并无调高平均销售价。

http://www.nanyang.com/node/567169?tid=462target=_ (Sept.2013 - FY2014)

- We believe that raw material prices, namely

latex and nitrile will continue to remain at favourable levels, hovering at RM5.50-

6.50/kg. This is mainly due to: 1) the soft auto sales growth in China in tandem

with the economic slowdown (China’s tyre makers accounted for 70% of total

global latex output); and 2) higher output from countries such as Cambodia and

Vietnam. The Economic Inteligence Unit (EIU) projects that latex output will

increase by +1.5% in 2013 and +4.5% in 2014. (Both latex and nitrile are key

earnings driver for the sector, as it accounts for 55-60% Harta’s operating costs) . On a YTD basis, latex and nitrile prices have fallen by -16.5% yoy and -24% yoy

respectively. The depressed rubber prices have resulted in a series of protests by

farmers in Thailand, which supplies 1/3 of global latex. While the Thai

government continued to provide incentives to its farmers, we believe the

concerns over any supply disruptions are unwarranted as our ground checks with

the glove manufacturers reveal that glove production is still progressing well.

(Affin research Sept.2013 - FY2014)

- Ongoing price competition had restricted Hartalega’s ability to pass on the rise in input prices, resulting in QoQ sales volume growing by a mere 1.5%. Packaging issues for a major Japanese customer and a larger base had also weighed down volumes. Blended ASP is now at RM95/’000 pcs (-2.5% QoQ, -10% YoY).

(Am research Nov.2013 - FY2014)

- Rubber prices saw a sudden increase largely driven by the automobile industry, which saw a 21% surge in China‟s automobile demand in Oct coupled with China‟s quarterly GDP growth of 7.8% giving hope to naphtha crackers to increase prices. Our concern also lies with the average selling prices for gloves that has fallen from RM145/kg (FY12) to RM108/kg (FY13) to the current quarter‟s RM95/kg due to declining cost input as well as selling lower range natural latex gloves to the broader market in the emerging markets.

(PublicInvest Research Nov.2013 - FY2014)

- 安聯研究指出,賀特佳管理層認為消費稅(GST)將不會造成任何生產成本,因該公司大部份原料(丁腈膠)是從海外進口,反觀膠手套生產商多使用本地樹膠原料,一旦在2015年4月1日實施6%消費稅時,將受到負面衝擊,不過,若是天然氣價格上調幅度超過20%,該公司將不能悉數轉移全部額外成本於客戶。

http://biz.sinchew.com.my/node/85577?tid=18 (Nov.2013 - FY2014)

- 艾芬投行研究分析员认为,政府为了控制财政赤字,极可能在2014年宣布上调电费。目前,手套业者的电力成本每年大约2000万至2800万令吉,或占总营运成本的3至4%。“若政府调高电费25%,我们的推算业者的电力成本,将上扬4至5%,而净利会受损约5%。"不过,分析员相信,手套业者有能力如往常般,通过调高产品价格把高电力成本转嫁给客户。因此,手套业者的赚幅只会在初期受到影响,因为成本转嫁通常会有1至2个月滞后效应。大马研究分析员也认同,电费涨价对手套业者的影响偏中和,反而占总成本50至60%的天然气和原料,涨价的冲击来得更大。

- 艾芬投行分析员表示,手套业者目前的电费成本介于每年2000万至2800万令吉,或相当于总生产成本的3%至4%。而占据总生产成本9%至10%的燃料成本组合,大致上分为:电费--3%至4%,天然气--5%,及生物燃料--1%。“假设业者不把电费涨幅转嫁,初步预估将对我们所追踪的国内手套业者,2014至2015财年的盈利预测,仅有0.2%至3.2%的影响。” 若业者把该成本冲击转嫁出去,分析员指仅需要把平均售价上调介于0.5%至1%即可。

- “但我们预见姗姗来迟的天然气调涨,可能会在明年出现,这将会带来较大的成本风险。”分析员解释,自2011年6月以来,共3次的天然气调涨建议都被展延了,相信政府在明年会把工业天然气费用上调19%。“我们相信业者将可把高涨的成本转嫁,即使天然气费用上调19%,仅会对净利造成2%的影响。”

- 大马橡胶手套制造商协会(MARGMA)会长林魁贤表示,电费调涨将大幅加重手套生产成本,并期望政府应该给予业者更多时间,以调整新的价格结构,并与客户进行商讨。” 该协会今日发出文告,随着电费调涨,每1000个手套生产成本将增加介于20至60美分(约64仙至1.93令吉),因此劝促买家和生产商进行产品价格调整时,将这成本涨幅纳入计算。林魁贤指出,赖于生产商使用的生产器材,随着电费调涨和其所带来的连锁反应下,手套生产成本将出现不同幅度增长。他认为,电费确实应该跟随市价浮动,不过,电费调整应该逐步进行,并在事前做出宣布,好让业者有足够的时间进行调整。

周一,能源、绿色工艺及水务部部长拿督斯里麦西慕宣布,半岛电费调高15%(每千瓦时4.99仙),沙巴则调涨 16.9%(每千瓦时5仙)。 2014年1月1日起,电费全面调涨。

- While the latex price has plunged 13% YTD, the price of NBR has

remained unchanged thus far. The price differential has thus

narrowed with NBR trading at a 6% discount to latex from as wide

as an 18% discount in Dec 2013. Nevertheless, demand for nitrile

gloves remains solid despite its ASP premium of around 5-7% over

the powder-free latex gloves.

(Maybank research Feb.2014 - FY2014)

- To hedge their USD-denominated receivables against USD:MYR volatility,

glove companies buy forward contracts (which expire in 2-3 months) to sell

USD when glove deliveries take place. However, in a rising USD:MYR

environment, glove companies may incur paper losses as the forward

contracts are locked in at a lower rate. As an example, Hartalega locked in

its USD:MYR at 3.20-3.25 for the next three months (compared to the

current rate of 3.35), which means there will be a paper loss in end-

4QFY3/15, if the spot rate is above 3.20-3.25.

(Maybank research Feb.2014 - FY2014)

- Hartalega has successfully dealt with the higher electricity tariff in Jan

2014 (+17%) by raising its ASP by around 1%. Looking ahead, we think the

sector may also see the implementation of the overdue gas hike. In total,

Malaysia has put off five proposed bi-annual gas price hikes (totalling

MYR15/mmbtu), which would have taken the gas tariff to

MYR31.10/mmbtu (+93% from current actual rate). However, we believe

the government will spread out the impending increases to avoid inflicting

a steep one-time gas hike. We have assumed a moderate MYR3/mmbtu gas

tariff hike (+19% to MYR19.12/mmbtu) in FY3/15.

- Given that gas accounts for 7% of Hartalega’s production costs and

assuming a MYR3/mmbtu gas hike (+19%), we estimate that the adverse

impact to the bottom line will only be 2%. However, as its key cost

component is NBR (50-55% of total production costs), we think the lower

rubber (latex: -23% YoY, NBR: -27% YoY) cost this year could more than

offset the higher gas cost. Hence, Hartalega’s margins could be unscathed

even without any adjustments to its ASPs.

(Maybank research Feb.2014 - FY2014)

- “电费调涨已使我们每1000只手套的生产成本增加15至30仙,视手套等级而定。比较每1000只手套约25令吉的整体生产成本,它并不会太高。” “惟,它仍会对我们的收支造成负面影响。” 郑金森说续称,能源成本包括天然气、电力和水供,仅占了整体成本的6%至7%。

- The recent natural gas tariff hike will increase its cost by

~19%. Based on the company’s natural gas cost of 7% to

total expenses, this will increase their production cost by

1.3% (19% of 7%).

- We understand that ASP is under pressure, which is most likely due to price competition and imbalance demand- supply situation in the rubber gloves market. It is worth noticing that ASPs have been on a downward trend since FY12.

- The neutralisation factor is the recent softening in latex

costs despite wintering season, which is currently trading at

RM4.63/kg vs. RM5.22/kg 3-6 months ago.

(HongLeong Research April.2014 - FY2014)

- 分析員說,在薪資與電費上漲下,膠手套工業成本騰漲,預料此工業5月1日後面臨另一輪天然氣價格20%調漲之衝擊。“預料天然氣價格調漲下,其天然氣付費每年增200萬令吉至1千200萬令吉。”賀特佳也利用生物質量作為替代能源,這較天然氣未漲價前廉宜達10%;其生物質量只佔使用的10%能源,廠方計劃在下一代綜合手套製造大廈(NGC)讓生物質量使用倍增。

- 剛公佈首9個月業績中,其營運賺益按年挫0.6%至28.9%,前期為29.6%;而第三季賺益27.9%,兩年內首次跌到低於28%。2009年至2013財政年,營運賺益分別為30至33%(2008年除外,為28%)。

展望未来,JF Apex证券分析员表示,贺特佳的赚幅在短期內难以復甦,因为营运成本增加,以及竞爭环境激烈。除了不久前实施的最低薪金制,以及电费在今年1月调涨,天然气价格也开始在5月调高,这对手套业者而言是不小的衝击。

分析員說,在薪資與電費上漲下,膠手套工業成本騰漲,預料此工業5月1日後面臨另一輪天然氣價格20%調漲之衝擊。“預料天然氣價格調漲下,其天然氣付費每年增200萬令吉至1千200萬令吉。”賀特佳也利用生物質量作為替代能源,這較天然氣未漲價前廉宜達10%;其生物質量只佔使用的10%能源,廠方計劃在下一代綜合手套製造大廈(NGC)讓生物質量使用倍增。

Production lines

- In line with our plans for expansion, the Group is currently installing ten new production lines in our 4th plant which will provide us with an additional capacity of approximately 2.9 billion pieces of gloves which would bring our total capacity to 6.2 billion pieces of gloves per annum.

(Annual report 2008)

-該公司旗下所有廠房集中在雪州八丁燕帶(Batang Berjuntai),透過高度自動化設備提升產能降低成本。關錦安說,勞力資本不是公司的首要考量,因此暫無到其他人力成本低廉的區域國家設廠。

- 目前,賀達麗嘉共有3間廠房,設有23條生產線,每年可生產32億隻手套 (about 139mil/line/year)。為應付市場殷切需求,賀達麗嘉耗資約2億3000萬令吉的第4及第5家新廠房,已在拓展藍圖中。隨著生產線增至43條,預計2010財年時,公司年產量將提高到90億隻。

- 賀特佳將以高產能生產線取代舊生產線,並寄望透過新廠房的落實提高手套產量至105億只,以滿足與日俱增的手套需求。

- 賀特佳執行主席兼董事經理關錦安在股東大會後表示,目前將專注在耗時3至5年的擴展產能計劃,提高產量及效率以滿足國外市場的需求。

- 擴展計劃包括將卸下1號廠房的10條生產線,並以6條高產能的生產線取代。1號廠房主要生產天然膠手套,客戶群來自發展中國家如中國

- 另外,也興建含有12條全新的高產能生產線的新5號廠房,預計2011年投入運作,屆時,產能將從目前的62億只手套增加至105億只。5號廠房則專注生產丁晴手套並外銷至已發展國家。

- “公司廠房目前都滿載運作,根本無法應付客戶多餘需求,我們希望透過增加產量及效率,未來可有更大的增產空間。

- “In addition, we expect two new advanced high capacity production lines from Plant 5 to come on stream before the end of this financial year. This will have an immediate positive impact on our earnings growth,” said Hartalega managing director Kuan Kam Hon said in a statement on Tuesday, Nov 10.

- He said furthermore, plant 5 expansion would add another eight advanced high capacity production lines by early 2011, while 10 old lines at plant 1 would be decommissioned and replaced with six high capacity lines.

- Kuan said the measures would bring its current annual capacity of 6.2 billion pieces to 10 billion pieces by the second quarter of its 2012 financial year.

- 賀特佳目前每年生產62億手套,其優質醫藥手套生產商,賺益按季增4.400分點至31.2%,這是業界最高的賺益。賀特佳廠房使用率由首季77%增長至次季82%,同時乳膠價挫12%至每公斤3令吉78仙,美元也按季走低3%。

- We understand that its current production capacity stands at 6.2 billion pieces per annum, with full utilisation mainly attributed to the strong demand for rubber gloves as a result of the H1N1 pandemic.

- 賀特達董事經理關錦安在股東特大會後表示,第一廠房的翻新耗資4000萬令吉,將以6條高能產線取代現有的10條舊款產線,估計可將現有的5億只手套年產量,提高3倍至大約每年12(报纸错误报道17億)只,並於7月投產(2011年六-八月竣工)。

- Currently, the group produces 6.2bil (报纸错误报道7bn) pieces of gloves a year and once all the new plants are upgraded and completed(Plant 5 new lines + Plant 1 upgrade/replacement), the group will produce 10bil (报纸错误报道9.7bn) pieces of gloves a year.

- The company expects glove production at a plant to reach 1.3 billion pieces, up from 500 million, after upgrading works are completed betweeen June and August 2011, director of sales and marketing Kuan Mun Keng said today in a telephone interview.

(Bloomberg Year2010)

- 目前,丁晴膠手套佔賀達麗嘉80%,剩余20%為天然膠手套。

- 该公司预计,在今年11月为最新厂房(第五间厂房)装配与启用其余的4条新生产线,以及停止使用第一间厂房的10条生产线,以6条高产能生产线取代,预料可在2012财年,将按年产能从目前的70亿只,增至100亿只。

- 该公司透露,未来2年的资本开销约1亿2000万令吉,将通过内部融资与贷款筹集。

- HARTA第五廠房10條新產線預計2011財政年全面竣工,估計可貢獻最高3億令吉營業額,全年放眼15至25%淨利成長。

- 公司董事經理關錦安表示,第五廠房目前已完成5條新生產線,開始生產丁晴手套,餘下5條生產線料現財政年內完成,年產量可達24億隻手套。

- 公司董事經理關錦安說:“我們正著手提昇第一廠房產能,預料2011年完工,手套年產量可從原有7億隻倍增至14億隻(产能增加7亿只),產品主要針對發展中國家市場。”

“早前有很多相關業者公佈會擴張產能,未來2年額外300億手套的產能對市場而言可不是個小數目。”

- 一旦第五家廠房于本財年底完工,產能達30億只,這廠房料貢獻3億令吉收入。第一家廠房的提升工程完工后,產能從每年的7億只增至14億只。

- 关锦安透露,公司目前的计划包括提升第一厂房产能及完成第五厂房的建造。他相信第五厂房于本财年(2011年3月31日)竣工投产后,营业额上看3亿令吉。就第一厂房而言,他说:“第一厂房扩建后,产能将从每年7亿只增加至14亿只手套。”

- 他预计,第一产房完成扩建和第五厂房竣工后,会有10条新高生产线全面投产,集团产能到了本财年底时将增加至每年95亿只。

- "Hartalega's plant is expected to run at full capacity till the end of the year based on current order." Kwan Kam Hon said. "Beyond December, no one knows. There could be some overcapacity next years." He said.

- At present, condition continue to be fine. The company commissioned three production lines in the current quarter and all are running at full capacity.

- As more capacity is commissioned, however, Kwan expects his marketing department will have to work harder to fill the capacity. "Early this year, there were orders waiting for our capacity. Now, we have to get new customers for the new capacity,"he says, adding the company has been able to secure new markets and customers.

- Kwan hopes the market will surprise him and that an overcapacity in the industry will not occur next year. As companies observe spare capacity in the industry, they may hold back some of their expansion. "if everyone slows down their expansion for 12 months, there will be a better balance between demand and supply," he says.

- As for Hartalega, "We will not be pushing very hard because the market is not pushing us," he says. This is unlike six months ago when production staff were hard-pressed.

- 丁晴手套佔賀特佳產能的80%,其他則是乳膠手套,該公司每年可生產80億雙手套,產品銷往世界23個國家。

- Since early-2010, nitrile gloves ASP has stayed below latex powder free (PF) gloves. The discount has widened gradually to 10% to 30% currently, depending on the prices quoted by the different glovemakers.

- 聯昌指出,賀特佳在第三季增設3條產線,產量達9億雙手套,讓總產能上漲至88億至90億雙,營運情況亦讓人鼓舞,使用率介於83至85%,手套平均售價則穩定在每1千雙34至35美元。

- Commenting on the quarterly financial results yesterday, Hartalega managing director Kuan Kam Hon said three new advanced high capacity glove production lines had come onstream during the quarter under review to increase its annual production capacity to nine billion pieces currently from 8.1 billion. Meanwhile, another high capacity production line for Plant 5 is expected to be completed by 4Q of the financial year ending March 31, he said.

- “We also note that due to escalating natural rubber prices and the weakening of the US dollar, it is increasingly difficult for natural rubber (NR) glove producers to grow their capacity. As a result, we are seeing more competition from NR glove producers that are converting their capacity to nitrile,” Kuan said.

- “Our facilities are specifically designed to produce high quality nitrile gloves at the lowest cost possible. As such, Hartalega is poised to face this new competition with its lean operations and superior products,” he said. |

- The key variance was due to the slightly higher than expected utlisation rate — 9M utilisation rate was 84% agaibnst our full-year FY11 utilisation rate assumption of 82%. Demand for nitrile gloves remained strong during the quarter as Hartalega continued to benefit from switching from natural rubber to nitrile gloves in view of escalating latex prices.

- The company is embarking on a new expansion plan (Plant 6) on a vacant piece of land adjacent to its five existing factories. This factory will house 10 lines (报纸错误报道12 lines) (+3 billion pieces), which will focus on producing nitrile gloves. Construction of this new plant will start in June 2011, with two lines slated to start commercial production in December 2011. Total capex needed for this expansion plan is around RM120 million, to be spread over two years and will be funded by internally generated funds.

- In total, the expansion into Plant 6 would increase Hartalega’s annual production capacity from 8 billion pieces currently to 9 billion by FY12 and 13 billion in FY13.

- 公司企業財務及業務發展董事關民敬提到,賀特佳在雪州的第6廠房即將在今年6月動工,預定在2013年首季竣工,投資成本超過2億令吉。

- “我們將分階段增加10條生產線,每年可帶來額外35億隻手套。”

-「第6號工廠會在今年6月左右動土,料2013財政年全面投入運作。到了明年1至2月,管理層預計,每季可增設兩條生產線,直到明年7至8月。一旦全面啟用,該工廠的全年手套產量將達107億件。以上數據符合我們的預期。」

- Ground works for Plant 6, which will have in total 12 lines,

will begin in June/July 2011, with full commissioning by FY13. By Jan/Feb 2012(FY2012),

management expects to start operating two lines per quarter until July/Aug 2012(FY2013) when

the plant is expected to be fully commissioned.When fully operational, Plant 6 is

expected to add capacity of c.3.5bn pieces of gloves p.a., taking end FY13 capacity to

10.7bn pieces of gloves per annum.

[CIMB Research 15.April.2011- FY2011]

- Management said Plant 6 will house 12 lines (+3 billion pieces per

annum), which will produce nitrile gloves. Construction of the new plant

will start in June/July 2011, with two lines slated to start production

in January 2012. Capital expenditure is around RM120 million, which

will be spread over two years and funded by internally generated funds.

The expansion will increase Hartalega’s annual capacity from eight

billion pieces to nine billion by FY12 and 13 billion in FY13.

- Hartalega is building Factory 6 to raise capacity to 13 billion pieces (+42%) over the next two years.

- Correspondingly, it is targeting to expand Plant 5 with an additional

two production lines that are expected to start commissioning in early

FY12. In addition, Hartalega is planning to build a new plant next to

its existing plants in Bestari Jaya, for which approval is still

pending.

- Hartalega aims to increase its production capacity by 40% to 13.5 billion pieces annually by 2015 from the 9.6 billion last year by building a sixth manufacturing plant and expanding production at its fifth plant.

- The sixth plant, costing RM175 million, will begin construction by December, to be completed in mid-2013. The fifth plant will add two new production lines by 1Q12 for RM20 million to RM30 million.

- “Even with Plant Five in operation, we oversold in the months of July to September and we do not have sufficient capacity to support demand from our customers, so we are desperately trying to expand our capacity as fast as possible. It will take some time to establish the new plant so as a stop-gap measure, we are building the two lines in Plant Five,” said Kuan.

- High prices of natural rubber have prompted glovemakers to seek refuge in nitrile and Kuan said this may lead to overcrowding in the nitrile glove sector. “The only thing we can do is to build the capacity to support the growth in our customers, if we stay put our customers will be left with insufficient products and choose to source from other suppliers, that is where we could lose ground,” he said.

- Supermax Corp Bhd and Top Glove Bhd have been tweaking production lines to have 70% of their capacity interchangeable between latex and nitrile. Top Glove plans to increase its production of nitrile gloves to 26% (what's the unit amount???) in FY12 from the 13% in 3QFY11. Supermax has increased its production of nitrile gloves to 33% in 1QFY11 from 24% (what's the unit amount???) in the preceding quarter.

- Given the rapid growth in demand for nitrile gloves, the company plans to add two new lines in Plant 5 in order to meet forward orders from clients. The two additional lines are expected to increase annual production capacity by 400 million pieces to 10 billion pieces (from 9.6 billion pieces currently) and are slated to begin production by 1Q12.

- The new factory will house a total of 10 lines focusing on producing nitrile gloves with two new lines slated to begin commercial production in January 2012 and the rest coming onstream progressively. These new lines will be the group’s most efficient lines to date with a production rate of 40,000 pieces per hour (against the industry average of 24,000 pieces per hour).

http://www.theedgemalaysia.com/mobile/article.php?id=192760 (Sept.2011 - FY2012)

- We expect the group to post a 2QFY12 volumes to rise slightly q-o-q (by about 3% to 4%) following the retrofitting of Plant 4.

- The group has around US$73 million (RM228.5 million) worth of forex forward contracts at an exchange rate of RM3.04 to RM3.07, with the bulk expiring in March 2012 (4QFY12). As at end 2QFY12, the ringgit stood at 3.19 per dollar and has tapered off to 3.11 presently, hence the loss will only widen should the rate rise above RM3.19 in March 2012. Even with the forex loss, Hartalega’s 1HFY12 results will still be broadly in line with our forecasts and consensus.

http://www.theedgemalaysia.com/mobile/article.php?id=195844 (Nov.2011 - FY2012)

- 副董事经理关民亮透露,贺特佳斥资资本开销1亿7500万零吉,增设第6家工厂,估计在2013年完工,每年可以贡献额外35亿只手套。

http://www.investalks.com/forum/viewthread.php?tid=74&extra=&page=21 #411 发表于 2011-12-5 小番薯

- 目前粉乳胶手套生产线使用率约70%,而无粉乳胶手套及丁腈手套则接近极限。

- 目前乳胶与丁腈手套的市场比例为70:30,在丁腈手套逐渐夺走乳胶手套市场的情势下,预见两者在未来五年的需求与销售比例将到50:50的水平。

- Sales volume growth in 4QFYMar12 will only

see a slight increase given that Hartalega is running at full capacity. The two new lines at Plant 5 will only come onstream in Feb 2012

(4QFYMar12), adding new production capacity of 500m pcs to existing

capacity of 9.6b pcs pa (+5%).

- Additionally, construction

of Plant 6 has already started and should be on track to meet its

targeted completion in FYMar14. We think Plant 6 will be a major

earnings kicker for Hartalega once it comes onstream, with planned

capacity of 3.5b pcs (+33% to 13.9b pcs pa), and should further bump

up its already fat margins due to higher productivity.

(Maybank IB Feb.2012 - FY2012)

- “由於預見丁晴手套未來需求強於市場預期,該公司正著手策劃在2013財政年展開龐大產能擴張活動,兩年內共將投資1億7千萬令吉資本開銷,包括設立具備10條產線的第六家工廠,預計全面告成後手套年產能可達35億隻。”

http://biz.sinchew.com.my/node/58050?tid=6 (Mar.2012 - FY2012)