Company background

- 1991年,Tan Sri林伟才成立了顶级手套

- 经过不断的努力,公司从成立时的3条生产线到如今全世界最大的胶手套生产商

source: http://www.topglove.com (as at Aug 2011)

- Top Glove founded in 1991, has been growing at a compounded annual growth rate of 30% over the past two decades

- OEM manufacturer

- Starting with RM180,000, Top Glove is now the world's largest glove makers with an enviable 25% share of the world's glove market

- Products

80% of production for healthcare and 20% for non-healthcare sector

81% natural rubber and 19% synthetic rubber gloves

- 22 manufacturing facilities across 3 countries (as at May 2012)

- Top Glove has an annual production capacity of 40 billion pieces of gloves churned out by 458 production lines

- Immediate plan is to increase production capacity by 4.8 billion pieces come August 2013. Six new factories, each yielding about 20 new production lines, are expected to be added over the next three years

- The longer-term plan is to spend RM3billion in the next 15 years to grow production capacity and possibly buy more rubber plantation land to add on to its 30,773ha in Indonesia.

- 80% of its total glove production is natural rubber gloves, aiming to have a more balanced mix of rubber and nitrile

- New production capacity will all be inter-changable between both glove types and based on demand

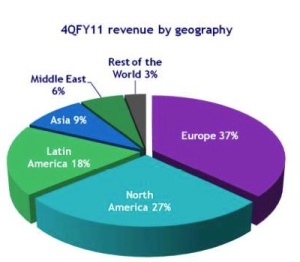

- Export to 185 countries with 1,000 customers globally, mostly in US and Europe that are engaged in a myriad of sectors including healthcare, retail and manufacturing. Asia makes up only 10% of the company's sales.

- Customers geographically diversified and no single biggest customer constitutes more than 4% of revenue. Customers are mainly distributors in the respective countries.

- Targets one new customer per week which works out to 52 new customers every year

- Top Glove has 110 sales staff but plans to hire more people in tandem with growth in demand

- Latex accounts for up to 60% of its production costs

- In the case of currency fluctuation, it hedges its US dollar receivables using plain vanilla forwards contracts, given that 98% of its sales are in US dollars

- Staff strength close to 11,000. Top Glove hires about 1,000 people every year, that's about 500 per new factory. This include about 200 fresh science graduates every year, to be employed in areas like R&D

- Top Glove became the first rubber glove maker to move upstream by acquiring its own rubber plantation land to ensure a consistent supply of latex. In June, it paid RM22 million for a 95% stake in PT Agro Pratama Sejahtera for some 30,000ha of green field rubber plantation land in Indonesia. Top Glove target is to secure up to 40% of its own latex supply, assuming that the land is fully planted it will provide up to 50% of Top Glove's current latex consumption

- Top Glove has allocated RM450 million for the rubber plantation project over 13 years (averaging 35 million per year), and this is inclusive of land cost, clearing, preparation, infrastructure, seedling and maintenance up to maturity stage. Plan is to spread the planting in stages over eight years and with a gestation period of six years before maturity.

- Dividend

Target dividend payout ratio is around 40% of profit attributable to equity.

Business

- Glove

- Plantation (Rubber)

- 顶级手套将于今年10月份起在印尼苏门答腊岛南部种植橡胶树,估计整个项目投资额达4亿5000万令吉。上述橡胶树种植园总面积3万772公顷,公司将在8年内逐步种植。基于种植橡胶树过度期为7年,预计2020年才能开始收割,整个发展计划耗时14年。

http://www.nanyang.com/node/503458 (Year-2013 Q1)

Brand

- Top Glove

- TG Medical

- Great Glove

- Master Guard

Cost

- 估计树胶价格每下跌RM1,顶级手套每月将可剩下RM10million,因公司每月的消耗量大约为10million公斤。

- 林伟才举例,公司员工月薪原1200令吉,现在已增至1800令吉,不包括超时,薪金增幅高达50%。尽管劳工成本上扬,但林伟才觉得庆幸的是,我国最低薪金仍低于印尼、泰国及中国,换言之,后者生产成本更高。

- 为了减少对员工的依赖,顶级手套过去1年积极投资机器设备,预计今年(2013)中旬生产全面自动化。

- 为了转移成本上涨风险,公司也把每1000只手套平均售价提高1至1.50美元(介于3.04至4.56令吉),涨幅介于3至5%。

- 林伟才认为,政府决定7月1日起调高天然气价格不实用、也不恰当,希望政府可提出更好的解决方案,让天然气客户与供应商受惠。

http://www.nanyang.com/node/503458 (Year-2013 Q1)

Products

- TopGlove's current OEM and OBM ratio is around 80% and 20% respectively. (MB Sept 2012)

Production lines

- As at June 30, TopGlove had 22 factories (16 in Malaysia, 4 in Thailand, 2 in China) and 442 production lines, producing 44 billion pieces annually. (MB Sept 2012)

- The group is setting up a central R&D facility at factory number 25 which is currently under construction and should be ready by end-2012. (MB Sept 2012)

- 今年(2013)8月,顶级手套的1间新厂房及2间现有厂房第二期工程将分别落成及完工。

- 林伟才说:“届时,我们将有23间厂房,生产线将增加52条至514条或相等于每年增加48亿只手套,按年总产量将增至451亿只。”

http://www.nanyang.com/node/503458 (Year-2013 Q1)

Customers

- 顶级手套目前出产的手套大约95%供出口(2011年)

- 出口至180个国家

- 超过1000个客户,没有单一客户贡献营业额超过4%

- 主要做OEM

资料来源:TopGlove 2011 Corporate Presentation

-目前,顶级手套全球市占率为25%,企业客户1800家、遍布185国。

http://www.nanyang.com/node/503458 (Year-2013 Q1)

Growth/Strategy

- Top Glove acquired GMP Medicare Sdn Bhd, a Melaka-based glove manufacturer, for RM24.1 million. GMP, which runs on 11 production lines, produces 570 million pieces of power-free latex gloves for the US market yearly. Consisting of two blocks of factories and 16.7 acres, it is, however, currently loss-making. TopGlove plan to invest to upgrade GMP's production lines, with a focus on technology and automation that are geared towards more robust production and to turn out high quality gloves at efficient cost. The effort to upgrade and re-furbish GMP's existing lines is estimated to require a capital injection of RM15mil-RM20mil. (MB Sept 2012)

- TopGlove's subsidiary, Best Advance Resources Ltd, acquire 95% equity of 5,700 shares in PT Agro Pramata Sejahtera for RM22mil. The Indonesian company holds a 60-year license to operate a rubber forest plantation covering 30,778 hectares on two islands east of the southern Sumatran city of Palembang - around 20,000ha in Kabupaten Belitung and about 10,000ha in Kabupaten Bangka. It is awaiting local authority approval to complete the S&P agreement. (MB Sept 2012)

- TopGlove's long term plan is to have around half of the group's latex supplied internally and will continue actively to acquire plantation lands in Cambodia, Indonesia and Malaysia. (MB Sept 2012)

- The company plans to invest RM3 billion over the next 15 years to expand and upgrade its production capacity as well as R&D and upstream and downstream activities. (MB Sept 2012)

- The group will build an estimated 40 new factories across Malaysia, Thailand and Indonesia, equipped with advanced technology. (MB Sept 2012)

- In a strategic move to avoid over-reliance on natural-rubber gloves, the company is expanding its nitrile glove production. Nitrile glove business is expanding and since year-2011, production rose 15% from 8%. The company will continue future expansion to focus on nitrile gloves. Lim, noting that customers, especially in the developed countries, also prefer them. (MB Sept 2012)

Nitrile gloves are synthetic gloves that provide an alternative for latex-sensitive users.

- 顶级手套放眼现财年手套产量提高10至15%,以抵消实际税率侵蚀赚幅所造成的冲击。

- 顶级手套主席丹斯里林伟才在2013财年首季业绩汇报会上说:“我们将采‘高销量、低赚幅’的经营策略,冀望以低成本生产更多优质手套,以抵消赚幅受侵蚀的影响。”

-顶级手套截至去年11月杪2013财年首季净现金录得3亿4590万令吉,足以落实各项拓展计划,包括设新厂、增加生产线以及种植橡胶树等。

- 林伟才称,当前经营环境艰巨,顶级手套唯有不断提高销量、确保产能符合经济效益满足市场需求及期望以提高竞争力。

- 询及顶级手套完成收购GMP Medicare公司后会否探讨其他并购时,林伟才说:“我们一直都在探讨并购机会。”

http://www.nanyang.com/node/503458 (Year-2013 Q1)

Financial ratio

在还没谈营业额前,先来看看下面的两个例子,它说明了一间公Sales-Margin-Net Profit之间的关系。从中探讨,我们就不难明白TopGlove为什么不断努力地扩大他们的销售额。

| 例子1 | Year 1 | Year 2 | Year 3 |

| Sales | 1,000,000 | 2,000,000 | 4,000,000 |

| Cost | (500,000) | (1,000,000) | (2,000,000) |

| Profit | 500,000 | 1,000,000 | 2,000,000 |

| Profit Margin | 50% | 50% | 50% |

| 例子2 | Year 1 | Year 2 | Year 3 |

| Sales | 1,000,000 | 2,500,000 | 8,000,000 |

| Cost | (500,000) | (1,500,000) | (6,000,000) |

| Profit | 500,000 | 1,000,000 | 2,000,000 |

| Profit Margin | 50% | 40% | 25% |

从上面两个例子,我们知道假如一间公司的赚幅(Margin)收缩,就好像现在的手套业Margin逐年下降,那么要维持每年一样的净利成长,公司就必须不断扩大营业额。例子2的Year 2和Year 3就很好说明了这个原理。另外,公司可以透过以下方式来提高营业额(Revenue):

- 增加销售量

- 提高商品价格

- 销售新的商品或服务

- 并购公司

| Sales | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| 138,862,134 | 180,202,451 | 265,089,094 | 418,133,120 | 641,827,120 | 992,611,000 | 1,228,778,000 | 1,377,931,000 | 1,529,077,000 | 2,079,432,000 | 2,053,916,000 |

TopGlove自上市以来营业额每年都在增长,可是成长率是差不多每年在下降的。值得注意的是2011年是自上市以来第一次出现负成长(-1.2%)。

毛利率(Gross Margin):

| Gross Margin | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| 25.2% | 24.4% | 22.1% | 20.0% | 18.3% | 17.1% | 17.5% | 16.5% | 24.4% | 21.1% | 11.4% |

乳胶是生产手套的主要原料,占成本的大约50%-60%或更多,再看看近几年爆涨的乳胶价格走势,就不难了解为何TopGlove的毛利率正逐年下降。2009-2011年尤其明显。

营业开销(Operating Expenses):

TopGlove一向来都把营运开销控制的很好,从下面图表显示的数据逐年下降就可看出。

但是我们需要知道一间公司是不可能单靠节省成本来维持净利成长的。营业成本控制的再好,也总有一个limit。照我看来,TopGlove的成本开销已经没有多大的下调空间,所以未来的净利成长还必须建立在市场需求。

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Distribution and Selling Cost | 9,355,525 | 13,528,586 | 15,998,598 | 21,924,162 | 27,594,798 | 34,799,000 | 43,771,000 | 46,520,000 | 95,484,000 | 66,008,000 | 00,000,000 |

| /Revenue | 6.74% | 7.51% | 6.04% | 5.24% | 4.30% | 3.51% | 3.56% | 3.38% | 6.24% | 3.17% | 00,000,000 |

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

| Administrative and General Expenses | 6,362,471 | 9,893,406 | 12,881,938 | 16,643,513 | 23,107,391 | 35,918,000 | 47,221,000 | 46,155,000 | 53,091,000 | 80,987,000 | 00,000,000 |

| /Revenue | 4.58% | 5.50% | 4.86% | 3.98% | 3.60% | 3.62% | 3.84% | 3.35% | 3.47% | 3.90% | 00,000,000 |

No comments:

Post a Comment